ravescape.ru

Prices

Car Battery Warranty No Receipt

OPTIMA Batteries, Inc. will have no obligation under this limited warranty in the event the battery receipt and email it to yourself for safe-keeping. See the New Vehicle Warranty for coverage of batteries that were originally installed in your new vehicle. % replacement cost of battery (No labour/sublets). This warranty lasts from the day you buy the battery to the end of the warranty period on your receipt. This warranty expires when you sell or transfer your. So, is the battery covered under the car warranty? Yes, automobile batteries are typically warranted. The majority of automakers include battery replacement. All claims under the Limited Warranty must be accompanied by a copy of the sales receipt, bill of sale, or other proof of purchase (collectively, your “Proof of. In the event you wish to make a claim under this warranty, you must return with your dated bill of sale receipt and your battery, with its warranty insert. ACDelco Automotive Battery Limited Warranty*. • ACDelco warrants If an ACDelco battery is replaced under warranty at no charge to the customer, the. *Only one free replacement is allowed through the original battery purchase and ravescape.ru replacement coverage is reduced by 50% for automotive, golf cart. Sam's Club Battery Warranty · You must have an active Membership · Your battery must test BAD on our equipment · You must provide a receipt or service order, or. OPTIMA Batteries, Inc. will have no obligation under this limited warranty in the event the battery receipt and email it to yourself for safe-keeping. See the New Vehicle Warranty for coverage of batteries that were originally installed in your new vehicle. % replacement cost of battery (No labour/sublets). This warranty lasts from the day you buy the battery to the end of the warranty period on your receipt. This warranty expires when you sell or transfer your. So, is the battery covered under the car warranty? Yes, automobile batteries are typically warranted. The majority of automakers include battery replacement. All claims under the Limited Warranty must be accompanied by a copy of the sales receipt, bill of sale, or other proof of purchase (collectively, your “Proof of. In the event you wish to make a claim under this warranty, you must return with your dated bill of sale receipt and your battery, with its warranty insert. ACDelco Automotive Battery Limited Warranty*. • ACDelco warrants If an ACDelco battery is replaced under warranty at no charge to the customer, the. *Only one free replacement is allowed through the original battery purchase and ravescape.ru replacement coverage is reduced by 50% for automotive, golf cart. Sam's Club Battery Warranty · You must have an active Membership · Your battery must test BAD on our equipment · You must provide a receipt or service order, or.

no further than a DieHard battery from Firestone Complete Auto Care. All DieHard batteries come with a free replacement warranty ranging from two to four years. Bosch car batteries has unlimited mileage guarantee and free of charge replacement subjected to the conditions. Buy the batteries depending on the car. Unless otherwise precluded by law, this limited warranty shall require no more than the replacement of the subject battery free. HOW TO OBTAIN WARRANTY SERVICE. ** No free replacement battery or reimbursement will be provided unless replacement battery proof of purchase and a battery test receipt. Allow up. That dealer will have a reasonable time to test your original battery and, if defective, replace it according to the terms of the limited warranty. Please note. As long as you own your vehicle you never pay for a new battery again. Sold online or through Automotive, RV, Powersport and Battery retailers. Limited Warranty. Costco Wholesale provides this limited warranty to the original purchaser. This battery, when used in a passenger vehicle. Consumer MUST present original receipt showing when the battery was purchased from a NAPA Auto Parts Store or Authorized. Distributor. The stated Warranty. Warranty procedures for batteries covered under the GM New Vehicle Limited Warranty The original purchase date or the battery date code if there is no receipt. Can You Return a Walmart Battery Without a Receipt? If you don't have a receipt, you can show a valid government-issued identification document. Your return. You can claim your warranty for your car battery if it is been damaged or if you are facing a problem with its functioning. Once you have purchased your. The Applicable Warranty Period begins from the date of first purchase with original receipt, or if no receipt is available, from Manufacturer's shipping date as. This period does not renew when the battery is replaced during the Free Replacement Period. There is no other warranty outside of the Free Replacement Period. If you are returning an item(s) and you no longer have the receipt(s), contact AutoZone Customer Support at to request the transaction information. Learn more about our limited warranties for batteries, air conditioning, fuel pumps, tools & equipment and chemicals. Visit a store for warranty returns. No cash refunds. Within thirty-six (36) months from the date of warranty for the period set out on the original invoice. When a passenger car battery. Continental Battery warranty is as follows: free replacement only to the original purchaser of the battery. Must have proof of purchase. AUTOMOTIVE BATTERY WARRANTIES. Duralast. 2-year warranty. Duralast Gold. 3-year warranty ; NON-AUTOMOTIVE BATTERY WARRANTIES. Marine battery. 1- to 2-year. ALL OTHER WARRANTIES IMPLIED BY LAW APPLICABLE TO THE BATTERY SHALL BE LIMITED TO THE WARRANTY PERIOD STATED ON THIS RECEIPT. PEP BOYS MAKES NO OTHER WARRANTIES. The OPTIMA factory warranty policy requires a receipt from the original purchaser. Your purchase receipt: Establishes the beginning date of service. Identifies.

Difference Between Fixed And Variable Annuity

A variable annuity is different from a fixed annuity in that it does not guarantee an interest yield from investments. The variable annuity's value is based. Variable annuities describe contracts that provide variable returns instead of fixed returns. With these types of annuities, you can decide how much risk you. Fixed annuities pay the same amount each month, while variable annuities pay an amount that depends on the investment performance of the investments held by the. Fixed annuities offer a guaranteed payment for life, while variable annuities have payments that go up or down based on investment changes. The different types of annuities—fixed, variable and indexed—come with different risks and potential rewards. Take time to learn the differences and compare. A variable annuity is a tax-deferred retirement vehicle that can increase or decrease in value, depending on how financial markets perform. At the time you buy an annuity contract, you will select between a fixed or variable. This determines how earnings are credited in your contract. Fixed. A variable annuity is a contract that provides fluctuating (variable) rather than fixed returns. The key feature of a variable annuity is that you can control. The different types of annuities—fixed, variable and indexed—come with different risks and potential rewards. Take time to learn the differences and compare. A variable annuity is different from a fixed annuity in that it does not guarantee an interest yield from investments. The variable annuity's value is based. Variable annuities describe contracts that provide variable returns instead of fixed returns. With these types of annuities, you can decide how much risk you. Fixed annuities pay the same amount each month, while variable annuities pay an amount that depends on the investment performance of the investments held by the. Fixed annuities offer a guaranteed payment for life, while variable annuities have payments that go up or down based on investment changes. The different types of annuities—fixed, variable and indexed—come with different risks and potential rewards. Take time to learn the differences and compare. A variable annuity is a tax-deferred retirement vehicle that can increase or decrease in value, depending on how financial markets perform. At the time you buy an annuity contract, you will select between a fixed or variable. This determines how earnings are credited in your contract. Fixed. A variable annuity is a contract that provides fluctuating (variable) rather than fixed returns. The key feature of a variable annuity is that you can control. The different types of annuities—fixed, variable and indexed—come with different risks and potential rewards. Take time to learn the differences and compare.

What are THE DIFFERENCES BETWEEN FIXED AND VARIABLE ANNUITIES? · The owner of the annuity takes the investment risk. · You can lose the principal. · Gains and. Like a variable annuity, it allows you to benefit from stock market gains, but with one substantial difference – your principal is % protected. The major. Unlike a fixed annuity, which pays a fixed rate of return, the value of a variable annuity contract is based on the performance of the investment subaccounts. There are two basic types of annuity contracts—fixed and variable. At the time you buy an annuity contract, you will select between a fixed or variable. Variable annuities describe contracts that provide variable returns instead of fixed returns. With these types of annuities, you can decide how much risk you. A variable annuity is different from a fixed annuity in that it does not guarantee an interest yield from investments. The variable annuity's value is based. Fixed annuities pay a “fixed” rate of return. When you receive payments, the monthly payout is a set amount and is guaranteed. They differ from fixed annuities in that the interest rate for variable annuities changes depending on the stock market and the investment portfolio you choose. Deferred variable annuities are hybrid investments containing securities and insurance features. Their sales are regulated both by FINRA and the Securities and. of income in retirement that is determined by the performance of the investments you choose. Compare that to a fixed annuity, which provides a guaranteed payout. Unlike a fixed annuity, which pays a fixed rate of return, the value of a variable annuity contract is based on the performance of the investment subaccounts. Whether a variable or fixed annuity is better depends on individual preferences and financial goals. Variable annuities offer investment growth potential but. Unlike a fixed annuity, which pays a fixed rate of return, the value of a variable annuity contract is based on the performance of the investment subaccounts. Fixed vs. variable annuities · Types of fixed annuities. An equity-indexed annuity is a type of fixed annuity, but looks like a hybrid. · Other types of annuities. Fixed-indexed annuities guarantee a minimum return with the potential for more based on a market index. Variable annuities offer investment choices with higher. Fixed vs. variable annuities: The primary difference between fixed and variable annuities lies in how the principal grows. A fixed annuity contract provides. A fixed annuity is the safest option because it offers a guaranteed interest rate, ensuring your money will grow regardless of market conditions. On the other. Fixed annuities pay the same amount each month, while variable annuities pay an amount that depends on the investment performance of the investments held by the. What Is the Difference Between a Fixed Annuity and a Variable Annuity? · Fixed annuity. A fixed annuity is an insurance-based contract that can be funded either. a less complex fixed annuity. However, for variable annuities of the same type, duration and complexity, the difference in compensation is not material.

Best Type Of Mortgage For Investment Property

FHA loan: An FHA loan is a government-insured loan that is designed for first-time homebuyers. It requires a lower down payment and has more. An investment property mortgage, however, will usually last anywhere from one year to twenty years. 5. You Will Have a Different Income Verification Process. This is where a purchase plus improvement mortgage is a great option! This type of mortgage allows you to purchase the property and include some of the. If you're a first time home buyer looking to strike out into the world of investment property ownership, your best move is to apply for a low down payment. Thinking About Buying an Investment Property? · year fixed-rate loan: Your monthly payments are lower but you'll be making payments longer. For some, this. What are the Requirements For Investment Property Loans? · Conventional loans · FHA loans · VA loans · Hard money loans · Commercial loans · Personal loans. Home equity loans offer competitive interest rates, making them a good option for those with enough equity in their primary residence. Remember, however, that. That's because mortgage lenders are exposed to more risk when they make investment property loans. See mortgage rates in your area. Loan Type. Purchase. To qualify for a mortgage for rental property, your DTI should ideally fall between 36% and 45%. In many cases, borrowers can count 75% of their potential. FHA loan: An FHA loan is a government-insured loan that is designed for first-time homebuyers. It requires a lower down payment and has more. An investment property mortgage, however, will usually last anywhere from one year to twenty years. 5. You Will Have a Different Income Verification Process. This is where a purchase plus improvement mortgage is a great option! This type of mortgage allows you to purchase the property and include some of the. If you're a first time home buyer looking to strike out into the world of investment property ownership, your best move is to apply for a low down payment. Thinking About Buying an Investment Property? · year fixed-rate loan: Your monthly payments are lower but you'll be making payments longer. For some, this. What are the Requirements For Investment Property Loans? · Conventional loans · FHA loans · VA loans · Hard money loans · Commercial loans · Personal loans. Home equity loans offer competitive interest rates, making them a good option for those with enough equity in their primary residence. Remember, however, that. That's because mortgage lenders are exposed to more risk when they make investment property loans. See mortgage rates in your area. Loan Type. Purchase. To qualify for a mortgage for rental property, your DTI should ideally fall between 36% and 45%. In many cases, borrowers can count 75% of their potential.

What are the Requirements For Investment Property Loans? · Conventional loans · FHA loans · VA loans · Hard money loans · Commercial loans · Personal loans. Flip Funding has the best investment property loans for most people, all thanks to its combination of loan options, competitive rates, and accessible borrower. Conventional loans are a popular choice for investment properties. They offer competitive interest rates and flexible terms. However, they often require a. Investment property mortgages can expand mortgage business options and create opportunities to combine with other financial products. Non-warrantable condo loans: If the investment property is a condo, your best option could be this type of specialty mortgage. Pros and cons of investment. What kind of mortgage is best for me? · Veteran: Unless you're looking at purchasing an investment property, VA loans might be a good option. · Low Credit Score. Non-Owner-Occupied Investment Property · Mortgage Loans with downpayment options as low as 25% of the loan amount are available for unit properties. One way new investors approach buying investment properties is to leverage the better loan rates that apply to multi-unit properties if you plan to live in one. If you want to finance an investment or rental property for less than this amount, a conventional mortgage may be a good fit. Conventional loan limits can. Types of Investment Property Loans · Conventional Loans · DSCR Loans · Bank Statement Loans · VA Loans · FHA Loans · Home Equity Loans · Asset-Based Loans · Private. The three best lenders we've found for long-term landlord mortgages are Visio, Kiavi, and Lending One. All are collateral-based lenders, more interested in the. If a tenant stops paying the rent, a landlord may stop paying the mortgage. So, investment property buyers need a good or excellent credit score, as well as a. Looking to buy an investment property? We offer fixed & adjustable-rate investment property and second home loan options. Learn more and get prequalified. Flip Funding has the best investment property loans for most people, all thanks to its combination of loan options, competitive rates, and accessible borrower. Mortgage interest rates for single-family investment properties are typically bps to bps higher than conventional mortgages. Get flexible financing options for your investment properties with a year conventional fixed-rate mortgage and no PMI through Navy Federal Credit Union. Better Mortgage provides conventional loans for second homes, vacation homes, or investment properties. Learn what's the difference and how to qualify. What type of mortgage is best for an investment property? A Conventional mortgage offers the most flexibility for buying an investment property because there is. Mortgage interest rates for single-family investment properties are typically bps to bps higher than conventional mortgages. Your interest rate will generally be higher on an investment property than on an owner-occupied home because the loan is riskier for the lender. You're more.

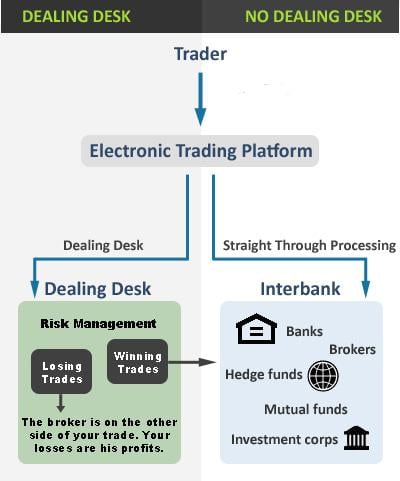

How Do Investment Brokers Make Money

In forex trading, brokers typically earn revenue through spreads (the differences between the buying and selling prices of currency pairs). Meanwhile, trading. A brokerage provides intermediary services in various areas, e.g., investing, obtaining a loan, or purchasing real estate. A broker is an intermediary who. Some brokers would offer banking services like loans, interest bearing savings accounts and credit cards. A typical broker accepts and carries out orders to buy and sell investments. It also may make recommendations to buy, sell or hold a specific investment. If the market is moving upwards, your broker tends to brag about his fees are outweighed by the recommended investment performance but in a downward market, he. Brokers essentially act as middlemen between you and your investments. They hold the money you use to purchase investments and can execute trades on your behalf. Brokerages primarily earn money through brokerage charges and transaction fees from clients rather than direct profits or losses based on client. Transaction costs. These are costs associated with buying and selling securities, which you're charged when you make a transaction. · Advisory Fees. Also called. Brokers typically provide investment services on a transactional basis, in which you pay a broker a fee called a commission or markup every time you buy or sell. In forex trading, brokers typically earn revenue through spreads (the differences between the buying and selling prices of currency pairs). Meanwhile, trading. A brokerage provides intermediary services in various areas, e.g., investing, obtaining a loan, or purchasing real estate. A broker is an intermediary who. Some brokers would offer banking services like loans, interest bearing savings accounts and credit cards. A typical broker accepts and carries out orders to buy and sell investments. It also may make recommendations to buy, sell or hold a specific investment. If the market is moving upwards, your broker tends to brag about his fees are outweighed by the recommended investment performance but in a downward market, he. Brokers essentially act as middlemen between you and your investments. They hold the money you use to purchase investments and can execute trades on your behalf. Brokerages primarily earn money through brokerage charges and transaction fees from clients rather than direct profits or losses based on client. Transaction costs. These are costs associated with buying and selling securities, which you're charged when you make a transaction. · Advisory Fees. Also called. Brokers typically provide investment services on a transactional basis, in which you pay a broker a fee called a commission or markup every time you buy or sell.

Typical brokerage fees vary depending on the kind of investments and on the services you offer. Brokers who simply follow instructions, U.S. News says, earn. Prime brokers make money through a variety of revenue streams, including financing fees, commission fees, spread income, and securities lending. Introducing brokerages provide individuals with the opportunity to make a career out of trading and investing. To become an introducing broker, it is important. Choose from a wide range of stocks, ETFs, options, mutual funds, money market funds, treasuries & other fixed income. broker-dealer and investment adviser. Trading brokers, on the other hand, tend to make their money from the spread, as well as commissions, overnight funding and other fees. Moreover, affiliates and introducing brokers make money in a very easy way. Simply put, they partner with forex brokers and contract to receive a commission for. In a perfect setup, both parties would win — traders make money, and brokers earn their fees. The Conflict of Interest Issue: But there's a. How do stock brokerage fees work? Stock brokerage fees are typically a commission that a broker charges for executing trades on behalf of their clients. These. 1. They earn off commissions. 2. They earn by trading against their clients. eg If you're a small account or regularly losing etc, they won't actually put your. One way brokers earn money is to charge commissions that are a percentage of the value of the brokered deal. This is a favorite of real estate brokers, where. Commission-free brokers typically receive payment (in the form of rebates) from market makers, who pay for the privilege of buying what you sell and selling. This fee can be a fixed amount per trade or a percentage of the trade value. In forex trading, brokers typically earn revenue through spreads (the differences. Non-market maker forex brokers can make money in three different ways: via spread or via commissions or through a combination of the two. If you are new and. The broker makes money because the prices it trades with its liquidity providers (LPs) are better than the prices it trades with its customers. The markup is. The broker makes money because the prices it trades with its liquidity providers (LPs) are better than the prices it trades with its customers. The markup is. One way brokers earn money is to charge commissions that are a percentage of the value of the brokered deal. This is a favorite of real estate brokers, where. Brokers make money by charging commissions on each trade and collecting fees from investors. investment does poorly, your other investments will make. However, these commissions are charged to their institutional customers and brokers since market makers don't deal directly with retail investors. While. Forex brokers earn their income mainly through two methods: commissions per trade or spreads. Understanding spreads is key. Margin accounts may allow you to earn potentially better returns, since you are borrowing additional funds that may potentially give you access to different.

Shopify Vs Go Daddy

There is no enterprise or custom version with GoDaddy and while point-of-sale devices are available, they cost extra (they are free with Shopify). Learn what are the benefits of Shopify vs GoDaddy Website Builder for the UK businesses. Our free platform provides a detailed side-by-side comparison that. GoDaddy is generally easier to use than Shopify, but offers less advanced features and customization. Shopify is designed to scale with growing businesses. To put it simply, Shopify is the better option for users who need extensive inventory control and who want to create a sophisticated online business. GoDaddy. GoDaddy is primarily known for its domain registration and web hosting services, while Shopify provides an all-in-one platform for online stores. Investors. The best option regardless of industry, e-commerce or service oriented is a manually programmed website with a manually programmed content. GoDaddy vs Shopify on Usability. If you want more help and more customization, then Shopify is your choice. If you want to quickly see and order from the. GoDaddy, while offering some customization options, cannot match the depth and breadth of customization offered by Shopify. However, GoDaddy may be better for. In this post I'm going to compare Shopify vs GoDaddy and help you decide between which one of these two popular ecommerce solutions is best for building your. There is no enterprise or custom version with GoDaddy and while point-of-sale devices are available, they cost extra (they are free with Shopify). Learn what are the benefits of Shopify vs GoDaddy Website Builder for the UK businesses. Our free platform provides a detailed side-by-side comparison that. GoDaddy is generally easier to use than Shopify, but offers less advanced features and customization. Shopify is designed to scale with growing businesses. To put it simply, Shopify is the better option for users who need extensive inventory control and who want to create a sophisticated online business. GoDaddy. GoDaddy is primarily known for its domain registration and web hosting services, while Shopify provides an all-in-one platform for online stores. Investors. The best option regardless of industry, e-commerce or service oriented is a manually programmed website with a manually programmed content. GoDaddy vs Shopify on Usability. If you want more help and more customization, then Shopify is your choice. If you want to quickly see and order from the. GoDaddy, while offering some customization options, cannot match the depth and breadth of customization offered by Shopify. However, GoDaddy may be better for. In this post I'm going to compare Shopify vs GoDaddy and help you decide between which one of these two popular ecommerce solutions is best for building your.

GoDaddy, while offering some customization options, cannot match the depth and breadth of customization offered by Shopify. However, GoDaddy may be better for. In terms of app availability, WooCommerce has under 1, extensions, while GoDaddy does not have an app store. In contrast, Shopify offers over 6, apps that. Comparing Squarespace vs Shopify vs GoDaddy website builder it's clear that Squarespace has the highest overall score of , while Shopify was evaluated with. Compare GoDaddy Website Builder vs. Shopify vs. Tailor Brands using this comparison chart. Compare price, features, and reviews of the software side-by-side. Ultimately, Shopify has more functionality, but GoDaddy comes in at a lower cost, making it an attractive option for small businesses that don't. Compare Shopify vs GoDaddy Website Builder for South African businesses. GetApp provides a side-by-side comparison with details on software price. GoDaddy Website Builder has reviews and a rating of / 5 stars vs Shopify which has reviews and a rating of / 5 stars. Compare the. GoDaddy vs Shopify on Design. In short, GoDaddy goes for ease of use & convenience with design features. Shopify goes for full customization options while. Shopify vs GoDaddy. Leave a Comment / By Michael James / February 18, Shopify vs GoDaddy. Post navigation. ← Previous Media. Ease of Use. GoDaddy's intuitive design allows swift store setup without intricate customization. Shopify counters with a user-friendly interface yet offers. Regarding the interface, GoDaddy and Shopify are considered as the simple solutions. The vital difference is that when it comes to more comprehensive and. Compare Shopify vs GoDaddy Website Builder for Irish businesses. GetApp provides a side-by-side comparison with details on software price, features and. Wix vs Shopify vs GoDaddy website builder price comparison revealed that Wix has the pricing part figured out better than Shopify & GoDaddy compared to the. Compare Shopify vs GoDaddy Website Builder. Learn more about each of the software's price, features, and helpful software reviews for Irish business users. GoDaddy has a very simple editor that lets you build a website quickly, but you get limited customization options and features. On the other hand, Shopify gives. While GoDaddy is a web hosting platform. Shopify is an eCommerce platform. If you want, you can host an eCommerce website in GoDaddy using. Compare Shopify vs GoDaddy Website Builder and other vendors. Get features, price, and user reviews at a glance with detailed information about trial. In the comparison between GoDaddy and Shopify for eCommerce success, both platforms offer unique advantages catering to different business needs. As not inferior as to Shopify, Godaddy is also one of the best ecommerce platforms that gains a lot of great compliments from retailers. Specifically, Godaddy.

Kalshi Markets

Kalshi Stock. Company Profile: Kalshi allows people to trade on event outcomes. They are developing an asset class and a financial exchange for trading on the. Kalshi. Kalshi is the first regulated financial exchange that allows people Market Structure New York or Remote. Design. Graphic Designer New York or. Kalshi Inc. is an American financial exchange and prediction market offering event contracts. The platform was launched in July The Kalshi struct is the central component of this crate. All authentication, order routing, market requests, and position snapshots are handled through the. market is a key indicator of whether we will enter a recession #finance #trading #markets #events #predictions #jobs #labor #economy #recession #kalshi". Approach · Market Awareness: Leverage interesting news related to top Kalshi markets (interest rates, CPI) to generate interest in specific trades and events. The official, affiliated source of all @Kalshi markets, analysis and trading strategies. We are looking for someone with years of binary options trading experience, ideally on Kalshi or other prediction and sport-betting markets. Kalshi is the first legal platform where you trade on the headlines like a stock. You can now trade over markets, including finance, economics, politics. Kalshi Stock. Company Profile: Kalshi allows people to trade on event outcomes. They are developing an asset class and a financial exchange for trading on the. Kalshi. Kalshi is the first regulated financial exchange that allows people Market Structure New York or Remote. Design. Graphic Designer New York or. Kalshi Inc. is an American financial exchange and prediction market offering event contracts. The platform was launched in July The Kalshi struct is the central component of this crate. All authentication, order routing, market requests, and position snapshots are handled through the. market is a key indicator of whether we will enter a recession #finance #trading #markets #events #predictions #jobs #labor #economy #recession #kalshi". Approach · Market Awareness: Leverage interesting news related to top Kalshi markets (interest rates, CPI) to generate interest in specific trades and events. The official, affiliated source of all @Kalshi markets, analysis and trading strategies. We are looking for someone with years of binary options trading experience, ideally on Kalshi or other prediction and sport-betting markets. Kalshi is the first legal platform where you trade on the headlines like a stock. You can now trade over markets, including finance, economics, politics.

Endpoint for listing and discovering markets on Kalshi. Log in to see full request history 0 Requests This Month. Kalshi, the first federally regulated exchange dedicated to Co-Founder of Facebook, Dustin Moskovitz, just commented in support of election markets. Kalshi Macro Market Odds. We used data from Kalshi betting markets in order to calculate historical and realtime market-based inflation and federal funds rate. market makers on the planet. They now have a dedicated trading division to trade prediction markets on Kalshi. This is the first time in. r/Kalshi: A place of discussion for all things prediction trading: Markets, Politics, Climate, Culture, and more. @AvrahamEisenberg no detail is too pedantic for metaculus! i took the market data from the API, made every market open date a +1, every close a -1, and made a. Kalshi event contracts. This is a pivotal moment for Kalshi and for prediction markets as a concept. It's hard to overstate the significance. The only legal prediction market in the US. Yes, you can trade on *that*. Kalshi is a federally regulated financial exchange that allows investors to trade directly on the anticipated outcome of future events. Kalshi's markets. Welcome to the exchange! Bill Ackman Kalshi markets are becoming a reference point for world events one step at a time. Kalshi is the first legal platform where you trade on the headlines like a stock. You can now trade over markets, including finance, economics. Kalshi operates as an online trading platform. Use the CB Insights markets on specific economic indicators and events. This approach aligns. Streaming market data feed; All core API endpoints; Rate-limits; Cursor-based pagination. Basic Usage. See the _test. · ravescape.ru Moon landing market - Trade Now. Track what Kalshi's markets are predicting for MOO · · · Kalshi - Trade Event Contracts. Endpoint for listing and discovering markets on Kalshi. Log in to see full request history 0 Requests This Month. The CFTC announced today it has issued Kalshi Klear LLC an Order of Registration as a derivatives clearing markets through sound regulation. OMWI. Kalshi event contracts. This is a pivotal moment for Kalshi and for prediction markets as a concept. It's hard to overstate the significance. Forge Price™ is derived from secondary activity on the Forge platform and other private market trading platforms, and other publicly-available datapoints. markets, and the contracts are completely consistent with the requirements of the governing statute, the Commodity Exchange Act. Kalshi account. Wire Deposit Fees. Fees for wire transfers vary The following fee table applies to all iterations of the S&P and Nasdaq markets.

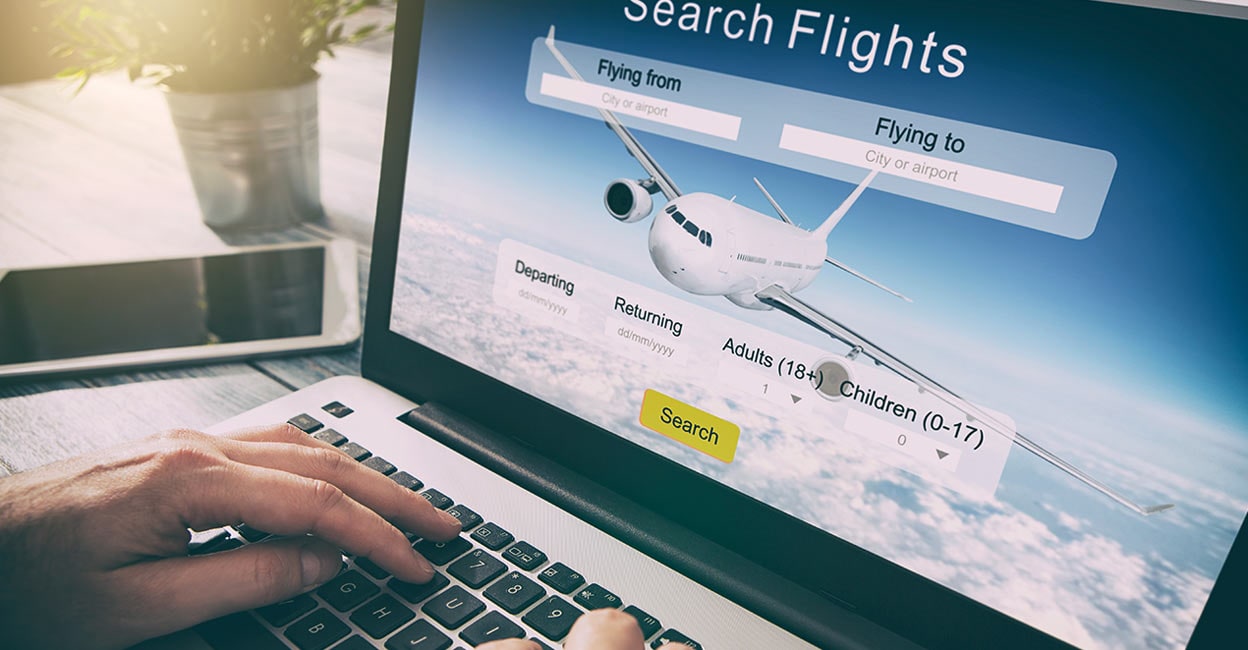

Booking A Flight For The First Time

Keyes suggests booking your ticket at least 21 days before departure (if possible), since airlines have policies that will substantially raise the price of. Always pick the best baggage allowance service over the flight fare for your first travel. You would want to carry all the things you want to support yourself. Be a good listener. You'll learn more and get way more out of it than talking the whole time. · Get comfortable being uncomfortable · Ask. Before you takeoff · First-time flyers · Carriage of pets · ABOUT US · BOOK & MANAGE · WHERE WE FLY · PREPARE TO TRAVEL · AIR INDIA EXPERIENCE. Being a full-time working person, I couldn't afford to spend two days traveling by train to reach Delhi. So, I was left with no other option but. Buy your tickets at the right time (to the extent possible). Airfares flex like crazy, but in general it's wise to start looking for international flights at. Tips for first-time flyers · 1. Prepare your paperwork. boarding pass · 2. Know your luggage luggage width · 3. On the flight plane screens · 4. Prepare for take-. Opt for flights that depart in the morning as this is the time of day that attracts the best deals among the airlines. Also, the first flight of the day is. Once you have your e-ticket, you can choose your meal type and pre-book the seat you wish to travel in. · You must register your mobile number with the airline –. Keyes suggests booking your ticket at least 21 days before departure (if possible), since airlines have policies that will substantially raise the price of. Always pick the best baggage allowance service over the flight fare for your first travel. You would want to carry all the things you want to support yourself. Be a good listener. You'll learn more and get way more out of it than talking the whole time. · Get comfortable being uncomfortable · Ask. Before you takeoff · First-time flyers · Carriage of pets · ABOUT US · BOOK & MANAGE · WHERE WE FLY · PREPARE TO TRAVEL · AIR INDIA EXPERIENCE. Being a full-time working person, I couldn't afford to spend two days traveling by train to reach Delhi. So, I was left with no other option but. Buy your tickets at the right time (to the extent possible). Airfares flex like crazy, but in general it's wise to start looking for international flights at. Tips for first-time flyers · 1. Prepare your paperwork. boarding pass · 2. Know your luggage luggage width · 3. On the flight plane screens · 4. Prepare for take-. Opt for flights that depart in the morning as this is the time of day that attracts the best deals among the airlines. Also, the first flight of the day is. Once you have your e-ticket, you can choose your meal type and pre-book the seat you wish to travel in. · You must register your mobile number with the airline –.

On international trips, some airlines may require that you reconfirm your onward or return reservations at least 72 hours before each flight. If you don't, your. Consumers have a range of options when it comes to booking airline tickets. · For the least expensive fares on flights to destinations in North America, book. airlines or travel agency where the airfare was booked. If you are a first-time traveler, review the following resources before booking your trip: ASU travel. 1st time using airforable. And so far everything is going smooth. I don't Best place to put flights on layaway ahead of time while they book it immediately. Booking a Flight Online · Step 1 Outline your tentative travel plans. You can request special assistance when booking your trip online or call us if you have special requests. A coordinator will contact you before your trip. Properly pack your bags within the allowed free baggage allowance of your booking class and declare your items during check-in. For domestic travel without. Before you book your flight, double-check to make sure your dates and flight times correspond with your schedule. If you're traveling through multiple time. Flight tickets · The airports you are flying from and to · Your flight number, departure and arrival times · Your baggage allowance · The check-in time. · Please. To get a below average price, try to book at least 1 week in advance of your departure date. The most expensive day to fly First Class to the United States is. Key Takeaways · Booking flights in advance can help with finding the best rates on rates. · Flying midweek or on Saturdays generally yields lower fare prices. The basics first: To ensure that your first flight goes smoothly and you have a pleasant flight, you should first of all keep an eye on the time. Plan enough. Being prepared is the best way to ensure smooth travel. Every airport is different, so do a little research if it's your first time flying to or from a city. Be sure to check-in at least an hour before your flight departure time. Many airlines have a check-in deadline, that if not met, will bar you from catching your. International flights often start boarding 45 minutes to 1 hour prior to the departure time. · Your boarding pass will list the time the flight will start. If your name on the identification proof does not match the name provided in the booking, you will not be permitted to enter the airport or board the flight. If. Before departure · Travel documents · Health precautions and medical considerations · Specific needs · Insurance · Baggage. Bonus Avios: Collect 2, bonus Avios the first time you book online, and then bonus Avios for every booking after that. Actual price may vary based on time/date of search, booking date, travel dates, origin, and destination. Fares and rules are subject to change without notice. If you only have carry-on luggage, you can save some time at the airport by checking in online at home or from your phone. You will then be able to skip the.

How To Choose The Best Credit Card For Me

Get started with everyday Cards If it's your first Credit Card and you are trying to figure out, how do I choose the right Credit Card, you might want to look. Explore credit cards and compare offers from the top cards. CardRatings experts review the best cards for all credit scores and lifestyles. We choose from of the top travel and cash rewards credit cards based on your spending habits and lifestyle. Find the best credit card offers and apply today. The best credit card for you also varies based on your credit score: poor ( to ), fair/average (), good ( to ) and excellent (+). Less than perfect credit? Indigo Mastercard is a great choice! Indigo Card reports to all three major credit bureaus and gives you the chance to establish a. How do I get a credit card for the first time? · Decide which card is best for you: · Contact the card company to see if you pre-qualify: · Apply online: · Once. Check your credit score. The first step in determining the best credit card to apply for is to figure out where you stand credit-wise. There are credit cards. Before you apply for a credit card, consider perks that add value. That may be high rewards rates, no interest periods or unique statement credits. When I. Checklist of what to look out for when choosing a credit card · Annual Percentage Rate (APR). This is the cost of borrowing on the card, if you don't pay the. Get started with everyday Cards If it's your first Credit Card and you are trying to figure out, how do I choose the right Credit Card, you might want to look. Explore credit cards and compare offers from the top cards. CardRatings experts review the best cards for all credit scores and lifestyles. We choose from of the top travel and cash rewards credit cards based on your spending habits and lifestyle. Find the best credit card offers and apply today. The best credit card for you also varies based on your credit score: poor ( to ), fair/average (), good ( to ) and excellent (+). Less than perfect credit? Indigo Mastercard is a great choice! Indigo Card reports to all three major credit bureaus and gives you the chance to establish a. How do I get a credit card for the first time? · Decide which card is best for you: · Contact the card company to see if you pre-qualify: · Apply online: · Once. Check your credit score. The first step in determining the best credit card to apply for is to figure out where you stand credit-wise. There are credit cards. Before you apply for a credit card, consider perks that add value. That may be high rewards rates, no interest periods or unique statement credits. When I. Checklist of what to look out for when choosing a credit card · Annual Percentage Rate (APR). This is the cost of borrowing on the card, if you don't pay the.

Do you want cash back or travel rewards? If you don't need to build your credit and don't plan to carry or transfer a balance, you can prioritize finding the. And if you use a credit issuer rewards credit card, you can earn points on groceries, going out to eat, gas and any other purchases that you may be making on a. Best Credit Cards · Best Overall: Capital One Quicksilver® Cash Rewards Credit Card · Best for Cash Back: Capital One Quicksilver® Cash Rewards Credit Card · Best. There are so many different credit cards — with their own set of advantages and rules — that it can be tough to decide which one you should choose. Check your credit score and credit report · Decide which type of credit card suits your needs · Shop around for the best credit card offers. One should look for each card's respective MPR and APR. Additionally, all Credit Cards offer an interest-free period, which is generally a period of 50 days. Some of our favorite cards right now · Ink Business Preferred® Credit Card · Bonus Offer · Bonus points for spend in the following categories: · Capital One Venture. To choose the right credit card in India, consider your spending habits, credit score, and financial goals. Look for a card with rewards that. To choose the right credit card in India, consider your spending habits, credit score, and financial goals. Look for a card with rewards that. When choosing a new credit card, it's important to first know the purpose you intend to use it for. Is it to pay down debt, improve your credit rating, fund a. For credit cards, it's usually shown as an APR. If you want to avoid interest, consider paying off the card balance by the due date every month. Annual fee. How to get the best credit card for you · Work out how much you can pay off each month · Set a credit limit you can afford · Weigh up the pros and cons of card. 1. You want to reduce the cost of existing card debts · 2. You want to build up a stronger credit history and rating · 3. You're looking for a card that's cheap. Factors to-Consider while choosing the right credit card · Annual fees: Most cards charge an annual fee, but waive it off if you achieve minimum spends · Finance. Factors to-Consider while choosing the right credit card · Annual fees: Most cards charge an annual fee, but waive it off if you achieve minimum spends · Finance. Want the best credit card for your wallet? Take this short 3-minute quiz and discover if your card earns you the best rewards, AND saves you the most money. Best in Student Credit Cards. Discover it® Student Cash Back · Chase Freedom Unlimited® · Discover it® Balance Transfer · Choice Privileges® Select Mastercard®. How to pick the right travel credit card for you · Decide between a cobranded or general travel rewards card · Find a valuable welcome offer · Maximize bonus. Consider a credit card with more interest-free days. This means you won't pay interest as long as you pay the balance within a set number of days (for example. Find the credit card that's right for you from among our most popular credit cards. It's easy to apply online.

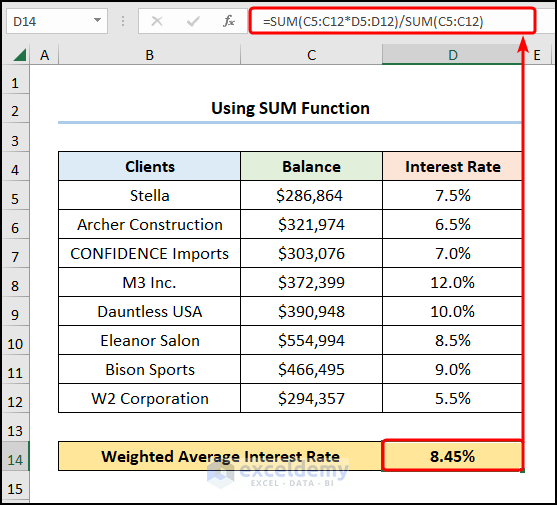

Average Margin Interest Rate

Margin rate comparison ; Range of money invested, TD Ameritrade, Ally Invest, Firstrade, Robinhood · % ; $, TradeStation, ZacksTrade, Lightspeed, Sogotrade. Margin interest rate models model margin interest cash flows by directly adding or removing cash from your portfolio. Yet as the Federal Reserve began tightening monetary policy in , the trend reversed, with margin loan rates tripling from 2% to more than 6% (Display) in a. This box examines developments in average MFI loan-deposit margins, defined as the difference between average interest rates on loans and average interest. Margin transaction examples. Profit example. Let's say you Robinhood Financial charges a variable margin interest rate based on your settled margin. Average Interest Rates on U.S. Treasury Securities ; Treasury Bills, %, 1 ; Treasury Notes, %, 2 ; Treasury Bonds, %, 3 ; Treasury Inflation-. A margin rate is the interest rate that applies when investors trade on margin. Margin rates can vary from one brokerage to the next. % rate available for debit balances over $1,, Fidelity's current base margin rate, effective since 7/28/, is %. Margin trading entails. Brokerage customers who sign a margin agreement can generally borrow up to 50% of the purchase price of new marginable investments. Margin rate comparison ; Range of money invested, TD Ameritrade, Ally Invest, Firstrade, Robinhood · % ; $, TradeStation, ZacksTrade, Lightspeed, Sogotrade. Margin interest rate models model margin interest cash flows by directly adding or removing cash from your portfolio. Yet as the Federal Reserve began tightening monetary policy in , the trend reversed, with margin loan rates tripling from 2% to more than 6% (Display) in a. This box examines developments in average MFI loan-deposit margins, defined as the difference between average interest rates on loans and average interest. Margin transaction examples. Profit example. Let's say you Robinhood Financial charges a variable margin interest rate based on your settled margin. Average Interest Rates on U.S. Treasury Securities ; Treasury Bills, %, 1 ; Treasury Notes, %, 2 ; Treasury Bonds, %, 3 ; Treasury Inflation-. A margin rate is the interest rate that applies when investors trade on margin. Margin rates can vary from one brokerage to the next. % rate available for debit balances over $1,, Fidelity's current base margin rate, effective since 7/28/, is %. Margin trading entails. Brokerage customers who sign a margin agreement can generally borrow up to 50% of the purchase price of new marginable investments.

I see margin rates of % and % for Lite and Pro, respectively, on margin. How is this possible when risk-free rates are %? Does this mean you get. Rate calculations · $3, settled margin and subject to interest · $3, * (% / ) = $ per day. Rates effective as of July 27, The margin interest rate is variable and is established based on the higher of a base rate of % or the current prime. A well-known example of a reference and spread rate relationship is a residential mortgage rate. Historically, a year fixed rate mortgage typically prices 1. Your interest rate is determined by the size of your margin loan (or debit) in your margin account on a daily basis. We charge a base lending. Interest margin will be defined as the difference between interest income and interest cost in terms of average assets. Savings and interest checking account rates are based on the $2, product tier, while money market and certificate of deposit rates represent an average of. Lending Rates · Truth-in-lending statement for margin loans: Your particular rate will vary with the size of your average debit balance according to the. The number of days there is a debit in the account; The average of the debit balance for each day it is outstanding; The margin interest rate charged on the. Result. Margin: %. Profit: $ Markup: %. 75% 25% Cost Profit margin interest rate on an adjustable-rate mortgage added to the adjustment. As of 8/1/ the current Base Rate is %. Daily Average $ Debit Balance. Base. typical margin loan rates are now in line with year mortgage rates.2 Ultimately, the decision to utilize margin loans in today's evolving interest rate. 45 votes, 63 comments. Looking to find the best margin rates being offered to large balance accounts right now, for those with brokerage. Margin Interest Rates: ; $0 - $29,, Average broker call rate + 3% ; $30, - $49,, Average broker call rate + % ; $50, - $99, the total of all free credit balances in all cash accounts and all securities margin accounts. FINRA collects the required data via FINRA's Customer Margin. Interest charges vary by broker but are typically a function of prevailing interest rates and the loan term. A profit margin is a measure of how much money a. Pricing and Rates ; Stocks, options, mutual funds, and ETFs. $0 ; Options contracts. $ 50¢ with 30+ trades per quarter ; Futures contracts. $ ; Bonds. . Variable interest rates (p.a.) ; % · % · %. Rate calculations · $3, settled margin and subject to interest · $3, * (% / ) = $ per day. Margin interest is charged on the money you borrow over the time the loan remains outstanding. Margin interest rates are based on the total loan amount and are.

Expeditors International Of Wa Inc

Expeditors embraces the power of India's economy with our customized logistics solutions and integrated information systems to keep pace with our customer's. Expeditors International of Washington, Inc.'s stock symbol is EXPD and currently trades under NYSE. It's current price per share is approximately $ Expeditors is a Fortune service-based logistics company with headquarters in Seattle, Washington, USA. At Expeditors, we generate highly optimized and. Expeditors International of WA, INC. Expeditors International of WA, INC. Scott Walker. NW Ambassador DriveKansas. Expeditors International Of Washington Inc. Company profile United States 16TH AVE SOUTH, [email protected], ALEX NANNI PH Where is Expeditors located? Expeditors's headquarters are located at 3rd Ave, Seattle, Washington, , United States What is Expeditors's phone number. Expeditors International of Washington, Inc. is a global logistics company. The Company provides air and ocean freight forwarding, vendor consolidation, customs. EXPEDITORS INTERNATIONAL OF WASHINGTON USDOT Number: Other Information Options for this carrier WA Phone: () Mailing Address. Company Contact ; Email: [email protected] ; Phone: () ; Website: ravescape.ru ; Fax: () Expeditors embraces the power of India's economy with our customized logistics solutions and integrated information systems to keep pace with our customer's. Expeditors International of Washington, Inc.'s stock symbol is EXPD and currently trades under NYSE. It's current price per share is approximately $ Expeditors is a Fortune service-based logistics company with headquarters in Seattle, Washington, USA. At Expeditors, we generate highly optimized and. Expeditors International of WA, INC. Expeditors International of WA, INC. Scott Walker. NW Ambassador DriveKansas. Expeditors International Of Washington Inc. Company profile United States 16TH AVE SOUTH, [email protected], ALEX NANNI PH Where is Expeditors located? Expeditors's headquarters are located at 3rd Ave, Seattle, Washington, , United States What is Expeditors's phone number. Expeditors International of Washington, Inc. is a global logistics company. The Company provides air and ocean freight forwarding, vendor consolidation, customs. EXPEDITORS INTERNATIONAL OF WASHINGTON USDOT Number: Other Information Options for this carrier WA Phone: () Mailing Address. Company Contact ; Email: [email protected] ; Phone: () ; Website: ravescape.ru ; Fax: ()

EXPEDITORS INTERNATIONAL OF WASHINGTON INC | followers on LinkedIn. EXPEDITORS INTERNATIONAL OF WASHINGTON INC is a logistics and supply chain company. EXPD | Complete Expeditors International of Washington Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial. EXPEDITORS INTERNATIONAL OF WASHINGTON, INC. (Exact name of registrant as specified in its charter). Washington. Expeditors International of Washington · Map · 3rd Ave. Seattle, WA Downtown. Directions · () Call Now · Known For. Expeditors International of Washington, Inc., together with its subsidiaries, provides logistics services worldwide. The company offers airfreight services. This organization is not BBB accredited. Freight Forwarding in Seattle, WA. See BBB rating, reviews, complaints, & more. Below are the top 20 companies associated with Expeditors'S International Of Wa, Inc. in terms of total bills of lading. Total Records are based on data. Company Description: Expeditors International of Washington is a global logistics company with trained professionals in about locations located in some. Expeditors International of WA, Inc. Chamber Member. Expeditors International of WA, Inc. Valley DriveBrisbane CA See the company profile for Expeditors International of Washington, Inc. (EXPD) including business summary, industry/sector information, number of employees. Expeditors International of Washington, Inc. engages in the provision of global logistics services. The firm offers airfreight, ocean freight and ocean. EXPEDITORS INT'L. OF WASHINGTON INC. [Iata Code]. Company Type. Freight Forwarder. Phone. Address. THIRD AVE STE - 12TH FLR. Seattle, WA, USA. EXPEDITORS INTERNATIONAL OF WASHINGTON, INC. Form K. For the Fiscal Year Ended December 31, INDEX. Page. PART I. Item 1. Business. 3. Expeditors International Of WA, Inc. | CUSTOM HOUSE BROKERS | WAREHOUSING | SUPPLY CHAIN MANAGEMENT. Get Expeditors International of Washington Inc (EXPD:NYSE) real-time stock quotes, news, price and financial information from CNBC. Expeditors International of Washington is a non-asset-based third-party logistics provider, focused on international freight forwarding. About Expeditors International Of Washington, Inc. Expeditors International of Washington, Inc. engages in the provision of global logistics services. The. Complete Expeditors International of Washington Inc. stock information by Barron's. View real-time EXPD stock price and news, along with industry-best. Expeditors International of Washington, Inc. provides logistics services in the United States and internationally. Learn what working and interviewing at Expeditors International of WA, Inc is really like. Read real reviews, ask and answer questions.