ravescape.ru

Market

Coinbase Shiba

Shiba Inu Markets ; 3. logo. Coinbase Exchange · SHIB/USD. $, $, ; 4. logo. OKX · SHIB/USDT. $, $, Shiba Inu can be staked through coinbase wallet on Shibaswap, where you will be getting 3 rewards in Bury(staking) section. You can buy SHIBA INU on Coinbase with an approved payment method, including a bank account, a debit card, or you can initiate a wire transfer. Shiba Inu (or SHIB) is a token designed to be an Ethereum-compatible alternative to Dogecoin (DOGE). Like DOGE, SHIB is intentionally abundant. Can I buy SHIBA INU on Coinbase? Yes, SHIBA INU is currently available on Coinbase's centralized exchange. For more detailed instructions, check out our. Shiba Inu is a cryptocurrency that operates on the Ethereum blockchain and has a high token supply and low token price, making it seem 'cheap' to investors. Shiba Saga's price has also fallen by % in the past week. The current price is $ per SHIA with a hour trading volume of $K. Currently. The $SHIBGF is a decentralized token of this Shiba Girlfriend platform. The token seeks to help the ecosystem fulfill its mission and carry it forward. Like. SHIBA INU is climbing this week. The current price of SHIBA INU is XAG per SHIB. With a circulating supply of ,,,, SHIB. Shiba Inu Markets ; 3. logo. Coinbase Exchange · SHIB/USD. $, $, ; 4. logo. OKX · SHIB/USDT. $, $, Shiba Inu can be staked through coinbase wallet on Shibaswap, where you will be getting 3 rewards in Bury(staking) section. You can buy SHIBA INU on Coinbase with an approved payment method, including a bank account, a debit card, or you can initiate a wire transfer. Shiba Inu (or SHIB) is a token designed to be an Ethereum-compatible alternative to Dogecoin (DOGE). Like DOGE, SHIB is intentionally abundant. Can I buy SHIBA INU on Coinbase? Yes, SHIBA INU is currently available on Coinbase's centralized exchange. For more detailed instructions, check out our. Shiba Inu is a cryptocurrency that operates on the Ethereum blockchain and has a high token supply and low token price, making it seem 'cheap' to investors. Shiba Saga's price has also fallen by % in the past week. The current price is $ per SHIA with a hour trading volume of $K. Currently. The $SHIBGF is a decentralized token of this Shiba Girlfriend platform. The token seeks to help the ecosystem fulfill its mission and carry it forward. Like. SHIBA INU is climbing this week. The current price of SHIBA INU is XAG per SHIB. With a circulating supply of ,,,, SHIB.

One of Coinbase's standout features used to be Coinbase Wallet, a hot Shiba Inu is an Ethereum-based altcoin that features the Shiba Inu hunting. Coinbase has disclosed that the addition of Shiba Inu into its new crypto derivatives contracts will allow its participants and clients to better manage risks. The current value of 1 SHIB is R$ BRL. In other words, to buy 5 SHIBA INU, it would cost you R$ BRL. Inversely, R$ BRL would allow you to trade for. Easily convert SHIBA INU to Canadian Dollar with our cryptocurrency converter. 1 SHIB is currently worth CA$ SHIBA INU is falling this week. The current price of SHIBA INU is $ per SHIB. With a circulating supply of ,,,, SHIB, it means that. You can buy SHIBA INU on Coinbase with an approved payment method, including a bank account, a debit card, or you can initiate a wire transfer. Based on trading volume and Trust Score, the most active exchange to trade Shiba Inu is KuCoin, followed by Coinbase Exchange. 2. Choose a suitable exchange. A decentralized exchange based on the Shiba Inu token (SHIB). On ShibaSwap your Shibs will DIG for BONES, or even BURY their tokens. One of Coinbase's standout features used to be Coinbase Wallet, a hot Shiba Inu is an Ethereum-based altcoin that features the Shiba Inu hunting. This guide is your roadmap, providing a clear, step-by-step breakdown of how to transfer Shiba Inu from BitMart to Coinbase. Shiba Inu Coin – SHIB/USD Final legThis would be the best path and in mid September around 0, buying Shiba seems quite reasonable. COINBASE:SHIBUSD. The current value of 1 SHIB is £ GBP. In other words, to buy 5 SHIBA INU, it would cost you £ GBP. Inversely, £ GBP would allow you to trade for. Easily convert SHIBA INU to Indian Rupee with our cryptocurrency converter. 1 SHIB is currently worth ₹ SHIBA INU · Polkadot · Currency Converter · BTC/USD · ETH/USD · BCH/USD · LTC/USD · DOGE Coinbase Global Inc (COIN). NASDAQ. Symbol. Exchange. Currency. COIN. M posts. Discover videos related to How to Buy Shiba on Coinbase on TikTok. See more videos about Shiba Inu How to Buy in Amharic, Coinbase How to Buy. Brian Armstrong: SEC Advised Coinbase to Delist Shiba Inu, Cardano, Solana, and Altcoins I think this subreddit is run buy the sec and. The rising demand of Shiba Inu Cryptocurrency brings many users new to the cryptocurrency space. Listing Shiba Inu on Coinbase would be a massive. As per their website, the Shiba Inu Coin can only be bought from the Uniswap platform. In order to buy the Shiba Inu coin, investors will have. Get the latest price, news, live charts, and market trends about Shiba The current price of Shiba in United States is $ per (SHIBA Shiba Inu Coin – SHIB/USDT. SHIBUSDT Binance. SHIBUSDT Binance. SHIBUSDT Some of the popular names are Binance, Coinbase, Kraken. But you'll have to.

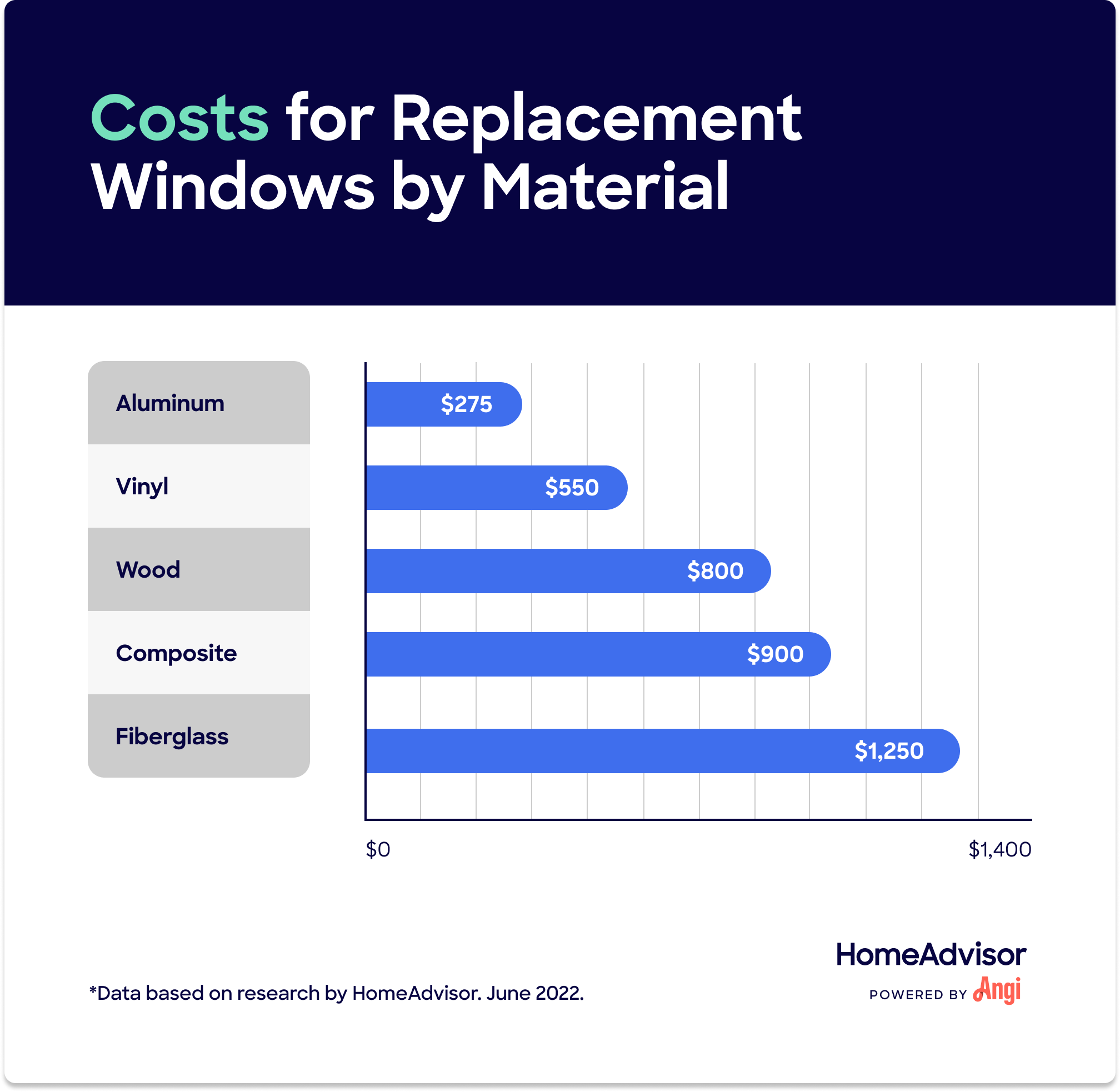

Window Replacement Cost Per Window

Window replacement cost by number of windows · 1 Window. $ - $ $ - $1, · 2 Windows. $1, - $1, $1, - $2, · 3 Windows. $1, - $2, Replacement windows cost between $ and $1, per window. That's a large price range, and it's determined by your. Window replacement costs typically range from $ to $1, per window, but homeowners will pay around $ per window on average. These costs can be. Window Replacement Costs ; Wood Replacement Windows (Low E and Argon Gas), $ to $, $24, to $36, ; Custom Shaped Windows (Vinyl), $ to $ Vinyl Windows · Awning: $ - $ · Bay: $4, - $6, · Casement: $1, - $1, · Double hung: $ - $1, · Shaped: $1, - $1, · Sliding: $ -. Replacing a single-hung window can cost between $ and $, depending on size and materials. Sliding Windows – $ to $1, Sliding windows have one or. Window replacement costs vary depending on the material and style, with vinyl, wood, fiberglass, aluminum and composite windows ranging from $$4, per. Replacing a single-hung window can cost between $ and $, depending on size and materials. Sliding Windows – $ to $1, Sliding windows have one or. Our research found that the average window replacement cost ranges from $ to $ Learn all of the factors that affect window costs in our guide. Window replacement cost by number of windows · 1 Window. $ - $ $ - $1, · 2 Windows. $1, - $1, $1, - $2, · 3 Windows. $1, - $2, Replacement windows cost between $ and $1, per window. That's a large price range, and it's determined by your. Window replacement costs typically range from $ to $1, per window, but homeowners will pay around $ per window on average. These costs can be. Window Replacement Costs ; Wood Replacement Windows (Low E and Argon Gas), $ to $, $24, to $36, ; Custom Shaped Windows (Vinyl), $ to $ Vinyl Windows · Awning: $ - $ · Bay: $4, - $6, · Casement: $1, - $1, · Double hung: $ - $1, · Shaped: $1, - $1, · Sliding: $ -. Replacing a single-hung window can cost between $ and $, depending on size and materials. Sliding Windows – $ to $1, Sliding windows have one or. Window replacement costs vary depending on the material and style, with vinyl, wood, fiberglass, aluminum and composite windows ranging from $$4, per. Replacing a single-hung window can cost between $ and $, depending on size and materials. Sliding Windows – $ to $1, Sliding windows have one or. Our research found that the average window replacement cost ranges from $ to $ Learn all of the factors that affect window costs in our guide.

This calculation assumes the use of double-hung vinyl windows and a 2,square-foot house with 1 window per square feet. Homes with upgraded window. When considering replacement windows cost, you'll find a wide price range as you shop around – anywhere from $ – $ 1, per window installed. Several. Window Replacement Costs ; Wood Replacement Windows (Low E and Argon Gas), $ to $, $24, to $36, ; Custom Shaped Windows (Vinyl), $ to $ A new or replacement window can give your home a much-needed boost. The average single window replacement cost is typically around $ - $ per window. Double-pane or insulated glass windows can cost significantly more to replace, with prices ranging from $ to $1, or more per window. It's. I've started getting quotes for window replacement on my home and our first estimator told me that “industry-standard” is about $$ per opening. The short, and admittedly imprecise, answer to “How much does window replacement cost?” is “between $ and $2,” The longer answer is that window. On average, window replacement (with installation) runs between $ and $1, per window for a white double hung insert. It is important to keep in mind. Replacement windows cost anywhere from $ to $ per window. High-end window replacements can cost well above $1, per window. You may have noticed. The most expensive window frame material is fiberglass, costing approximately $ - $1, per window. Fiberglass windows have a high initial cost but offer. The national average cost to replace windows is $20, according to the Cost vs. Value Report. This data is based on replacing 10 double-hung windows. The average cost to replace windows ranges between $ and $ per window, plus installation fees, but many factors influence the price you'll ultimately pay. The basic cost to Install Replacement Windows is $ - $ per window in April , but can vary significantly with site conditions and options. This calculation assumes the use of double-hung vinyl windows and a 2,square-foot house with 1 window per square feet. Homes with upgraded window. Homeowners experience an unpleasant surprise when they find out that, on average, the replacement costs $$ per window. On average, homeowners can expect to pay $4,$8, for a full window replacement in Wisconsin. To estimate your window replacement cost, try our free window. When considering replacement windows cost, you'll find a wide price range as you shop around – anywhere from $ – $ 1, per window installed. Several. Replacement windows cost between $ and $1, per window. That's a large price range, and it's determined by your. According to Home Advisor, the average window replacement can be anywhere from $ to $1, per window. This range makes finding a fair price for your. While the labor cost of window replacement ranges between $ and $ per window, other things affect the cost of replacing the windows in your home or.

Industries In Stock Market

Sector watch. Dow 30 · NASDAQ · Sectors. Sector Watch Chart. SYMBOL, PRICE Global Business and Financial News, Stock Quotes, and Market Data and Analysis. All Stocks ; Reliance Industries. ₹3, ; TCS. ₹4, ; HDFC Bank. ₹1, ; ICICI Bank. ₹1, ; Bharti Airtel. ₹. The U.S. stock market is divided into 11 major sectors that cover every key industry. Sectors include energy, information technology, consumer staples. Today's Stock Market's Best Performing Stocks, Sectors and Industries ; 5, Financial, % ; 6, Transportation, % ; 7, Services, % ; 8, Technology, What Are the 11 Stock Market Sectors? · 1. Energy sector · 2. Materials sector · 3. Industrials sector · 4. Utilities sector · 5. Healthcare sector · 6. List of the 11 Sectors of the Stock Market · Information Technology – $XLK · Healthcare – $XLV · Energy – $XLE · Real Estate – $VNQ · Financial – $XLF · Basic. All Sectors. +% ; Real Estate. +% ; Consumer Discretionary. +% ; Information Technology. +% ; Energy. +%. The uranium industry was the hottest industry in the stock market, up %. In the last week, the uranium industry was up %. In the past 52 weeks, the. The Major Market Sectors page shows the performance of sectors and industries within your selected market. The U.S. market ranks each of the ten S&P sectors. Sector watch. Dow 30 · NASDAQ · Sectors. Sector Watch Chart. SYMBOL, PRICE Global Business and Financial News, Stock Quotes, and Market Data and Analysis. All Stocks ; Reliance Industries. ₹3, ; TCS. ₹4, ; HDFC Bank. ₹1, ; ICICI Bank. ₹1, ; Bharti Airtel. ₹. The U.S. stock market is divided into 11 major sectors that cover every key industry. Sectors include energy, information technology, consumer staples. Today's Stock Market's Best Performing Stocks, Sectors and Industries ; 5, Financial, % ; 6, Transportation, % ; 7, Services, % ; 8, Technology, What Are the 11 Stock Market Sectors? · 1. Energy sector · 2. Materials sector · 3. Industrials sector · 4. Utilities sector · 5. Healthcare sector · 6. List of the 11 Sectors of the Stock Market · Information Technology – $XLK · Healthcare – $XLV · Energy – $XLE · Real Estate – $VNQ · Financial – $XLF · Basic. All Sectors. +% ; Real Estate. +% ; Consumer Discretionary. +% ; Information Technology. +% ; Energy. +%. The uranium industry was the hottest industry in the stock market, up %. In the last week, the uranium industry was up %. In the past 52 weeks, the. The Major Market Sectors page shows the performance of sectors and industries within your selected market. The U.S. market ranks each of the ten S&P sectors.

Thinking of the market in terms of sectors can be advantageous for investors; however, sorting stocks into separate sectors and industries may not be as clear. All listed stocks sorted by sector · Energy - Fossil Fuels · Renewable Energy · Uranium · Chemicals · Mineral Resources · Applied Resources · Industrial Goods. SIFMA is the voice of the nation's securities industry. We advocate for effective and efficient capital markets. Learn More About Us. Sector SPDRs are subject to risk similar to those of stocks including those regarding short selling and margin account maintenance. All ETFs are subject to risk. There are currently 11 sectors and 69 industries. Several of the 69 industries do not have companies represented in the S&P Index; therefore, performance. Select a Sector for a Visual Breakdown ; Technology. % ; Financial Services. % ; Healthcare. % ; Consumer Cyclical. %. The chart below breaks down the annual performance of the S&P sectors. Not only do you get an idea of how a small group of stocks affects the S&P each. Companies in this sector include 3M, Boeing, and Siemens. Show More. Market Cap. T. Market Weight. %. Industries. Companies. Industrials S&P. Nervous you might own S&P stocks that will get swept up in the market's sell-off? There's a way to see which stocks investors are most eager to bail on. Stock market sectors represent a general field of business and companies. The sectors are further filtered based on principal businesses, common products. Stock market sectors of USA ; Finance, T USD, % ; Health Technology, T USD, % ; Retail Trade, T USD, % ; Consumer Non-Durables, A sector exchange-traded fund (ETF) invests in the stocks and securities of a specific sector, typically identified in the fund title. An industry is a. Our S&P Sector and Industry Indices measure segments of the U.S. stock market as defined by GICS®. GICS enables market participants to identify and analyze. Sector investing is the practice of investing in one or more sectors of the economy. There are 11 main sectors across equity markets: Energy, financials, health. equity characteristics. Funds overview. View funds that move the market, screen for funds and read relevant news. Data Provided by LSEG. LSEG. All markets data. All Sectors ; Banks · 5,, (%) ; Software & IT Services · 4,, (%) ; Automobile & Ancillaries · 3,, (%) ; Finance · 3,, (%). Business Cycles and Cyclical Sectors · Financials (near the beginning) · Transportation (near the beginning) · Other industrials · Energy (near the end). Late/. Stock Market & Sector Performance · Percentage of Large Cap Stocks Above Their Moving Averages · More S&P Indexes · Russell Indexes · Dow Jones Indexes · Nasdaq. An industry group is a way of grouping individual companies or stocks based on common business lines. · GICS categorizes stocks into 25 industry groups and Sectors FAQ. What is the hottest sector in the stock market today? The basic material sector was the hottest sector in the stock market, up %. In the last.

O Balance Transfer Fee

Why we like it: The Chase Freedom Flex shines in the balance transfer category with its 0% APR offer for 15 months on balance transfers and purchases. This. New cards may have a temporary low or 0% introductory annual percentage rate (APR) for transferred balances. Transaction fee. Balance transfer card interest. The 3% balance transfer fee (or sometimes even a 5% fee) is absolutely worth paying when transferring your balance to a card that has a 0% intro APR offer. The annual percentage rate for cash advances is %. 2. 1% foreign transaction fee. Balance transfers and loan advances will accrue interest from the date the. secure site. See Rates & Fees. Balance transfer intro APR. 0% introductory APR balance transfers for first 18 billing cycles after account opening. With a 0% balance transfer you get a new card to pay off debt on old credit and store cards, so you owe it instead, but at 0% interest. A card will have a 0%. Balance Transfer Fee. Intro fee of either $5 or 3% of the amount of each transfer, whichever is greater, on transfers made within the introductory offer. After the intro period, a variable APR of Min. of (+) and %–Min. of (+) and %. Balance transfer fee applies, see pricing. There's a 3% fee to transfer a balance onto the card but after that you'll pay no interest on it or the first year. A 0% interest rate is as low as you can get;. Why we like it: The Chase Freedom Flex shines in the balance transfer category with its 0% APR offer for 15 months on balance transfers and purchases. This. New cards may have a temporary low or 0% introductory annual percentage rate (APR) for transferred balances. Transaction fee. Balance transfer card interest. The 3% balance transfer fee (or sometimes even a 5% fee) is absolutely worth paying when transferring your balance to a card that has a 0% intro APR offer. The annual percentage rate for cash advances is %. 2. 1% foreign transaction fee. Balance transfers and loan advances will accrue interest from the date the. secure site. See Rates & Fees. Balance transfer intro APR. 0% introductory APR balance transfers for first 18 billing cycles after account opening. With a 0% balance transfer you get a new card to pay off debt on old credit and store cards, so you owe it instead, but at 0% interest. A card will have a 0%. Balance Transfer Fee. Intro fee of either $5 or 3% of the amount of each transfer, whichever is greater, on transfers made within the introductory offer. After the intro period, a variable APR of Min. of (+) and %–Min. of (+) and %. Balance transfer fee applies, see pricing. There's a 3% fee to transfer a balance onto the card but after that you'll pay no interest on it or the first year. A 0% interest rate is as low as you can get;.

0% intro APR for 12 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. BECU does not charge Balance Transfer fees. We will apply minimum payments at our discretion, and we will apply amounts that exceed the minimum payment amount. An interest-free balance transfer card works best if you can pay off the balance in full by the end of the 0% period, because after this the rate is likely to. Enjoy 0% interest on balance transfers for 12 months with our credit card Looking for a bit of breathing space on your existing credit card balance but don't. Get a % introductory interest rate on Balance Transfers for 9 months with a 2% transfer fee∆ and we'll waive the $29 annual fee for the first year. Get a. Most balance transfer credit cards require you to pay a balance transfer fee of 3% to 5% of the transfer amount. For example, a $10, balance onto a card with. A 3% fee applies to all balance transfers for the first 60 days your account is open, then 4%. In addition, the card offers earning potential with up to 3% cash. Fees generally range between 2% and 5% of the amount transferred or a fixed amount like $10, whichever is greater. Balance transfers allow you to save more. Many balance transfer credit cards charge a fee of between 3% and 5% of the amount you transfer. In some cases, these fees can nullify your potential savings. Best for no fees: Citi Simplicity® Card. With no annual fee, late fees, or penalty APR, the Citi Simplicity® Card stands out as a consumer-friendly option. Get 0% APR for 15 months on balance transfers and purchases. 3% Intro fee on balances transferred by April 10, Then % to % Standard Variable. The BT fee with 0% BT APR is worth it if you have any significant balance. Usually works out to be months of interest if you were paying high APR on it. You can expect to pay a balance transfer fee of 3% to 5% of the amount you're transferring, but you don't have to pay this fee out of pocket. Instead, it's. Intro fee of either $5 or 3% of the amount of each transfer, whichever is greater, on transfers made within the introductory offer. After that: Either $5 or 5%. A balance transfer fee is generally 3% or 5% of the amount you transfer. So a $5, balance transfer with a 5% fee would come out to $ This fee is often. 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. See pricing and terms for details. Choice One VISA Classic and Platinum Credit Cards feature 0% APR* on balance transfers for 6 months with no balance transfer or annual card fees. Balance transfer fees may apply. A balance transfer can give you the flexibility to: Pay off high-interest balances; Fund large expenses, such as home. You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The. When transferring a balance to a credit card, generally you pay a transaction fee of 3%–5% of the transferred amount. However, the long-term savings from the.

Average Mortgage Interest Rate Georgia

Mortgage rates in the state of Georgia are currently slightly below the national average of %. Rates for year mortgages are averaging about %. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %. Today's mortgage rates in Georgia are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). No down payment required: For many servicemembers, this is the most attractive feature of a VA loan. · Lower interest rates: VA loans typically offer interest. Home interest rates have varied widely since Freddie Mac began tracking them in The first time the monthly average rate for a year fixed-rate mortgage. In Alabama, most lenders in our data are offering rates at or below %. · Data table · Explore what a lower interest rate means for your wallet. Track live mortgage rates ; %. 30 Year Fixed. % ; %. 15 Year Fixed. % ; %. 20 Year Fixed. %. Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. The mortgage rates in Georgia are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of September 03 Mortgage rates in the state of Georgia are currently slightly below the national average of %. Rates for year mortgages are averaging about %. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %. Today's mortgage rates in Georgia are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). No down payment required: For many servicemembers, this is the most attractive feature of a VA loan. · Lower interest rates: VA loans typically offer interest. Home interest rates have varied widely since Freddie Mac began tracking them in The first time the monthly average rate for a year fixed-rate mortgage. In Alabama, most lenders in our data are offering rates at or below %. · Data table · Explore what a lower interest rate means for your wallet. Track live mortgage rates ; %. 30 Year Fixed. % ; %. 15 Year Fixed. % ; %. 20 Year Fixed. %. Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. The mortgage rates in Georgia are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of September 03

On the week of August 20, , the current average interest rate for a year fixed-rate mortgage increased 2 basis points from the prior week to %. The. Today's competitive mortgage rates ; Rate % ; APR % ; Points ; Monthly Payment $1, YearARM Mortgage Rate ; Oct, ; Nov, ; Dec, ; Jan, The most recent value is percent as of May , an increase compared to the previous value of percent. Historically, the average for Georgia. Compare Georgia mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Today's Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · year. A fixed-rate loan of $, for 30 years at % interest and % APR will result in a monthly payment of $1, Taxes and insurance not included;. Current rates in Atlanta, Georgia are % for a 30 year fixed loan, % for 15 year fixed loan and % for a 5 year ARM. Data provided by 3rd party. What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt. The national average mortgage rate is %. Find out what your How does the mortgage interest rate differ from the annual percentage rate (APR)?. Get the latest mortgage rates for purchase or refinance from reputable lenders at ravescape.ru®. Simply enter your home location, property value and loan amount. Georgia's average year fixed mortgage rate is % (Zillow, Jan. An adjustable-rate mortgage (ARM) typically offers a lower initial interest rate than a. Current year fixed mortgage rates are averaging: % Current average rates are calculated using all conditional loan offers presented to consumers. The current average year fixed mortgage rate in Georgia decreased 2 basis points from % to %. Georgia mortgage rates today are 8 basis points lower. The average Georgia mortgage was $, compared to the national average of $, Getting pre-approved will help you determine what size mortgage you can. Mortgage rates fell to an average of % for year loans, according to Bankrate's lender survey. Thirty-year mortgage rates haven't been this low since. The following table shows current year Mountain View mortgage refinance rates. You can use the menus to select other loan durations, alter the loan amount. Secure your best GA mortgage and refinance rates with options like FHA, VA loans. Enjoy rates almost as admirable as scenic Georgia, ideal for homebuyers. Today's mortgage rates in Columbus, GA are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check. Compare Georgia's mortgage rates and refinance rates from today across home loan lenders and choose one that best fits your needs.

Best Bank Account For Small Business Uk

Tide Business Bank Account · Yes · Salman Haqqi ; Zempler Bank formerly Cashplus Business Account · Yes · Salman Haqqi ; Revolut Business Basic Account · No · Lucinda O. Review the best business bank accounts for SMEs and sole traders plus other money saving tips to keep your business bills down with Money Saving Expert. Here we run through the best business bank accounts for startups, sole traders, company directors and even larger SMEs ('small and medium enterprises'). Open a UK business bank account. The UK has many banks that offer business accounts to international businesses and entrepreneurs. Our world-class banking. Virgin Money offers % cashback on your business debit card spending and has an instant access savings account (with a minimum deposit of £1). Starling Bank is one of the newest challenger banks, trying to transform the banking industry in the UK. They offer a generous free bank account tied into a. Virgin Money offers % cashback on your business debit card spending and has an instant access savings account (with a minimum deposit of £1). If you operate as a small business, require everyday transactional banking services and multiple ways to access your account, apply online for our Small. Best business bank account for small business start up · Deals frequently with cash or cheques - NatWest · Want to keep your banking and savings. Tide Business Bank Account · Yes · Salman Haqqi ; Zempler Bank formerly Cashplus Business Account · Yes · Salman Haqqi ; Revolut Business Basic Account · No · Lucinda O. Review the best business bank accounts for SMEs and sole traders plus other money saving tips to keep your business bills down with Money Saving Expert. Here we run through the best business bank accounts for startups, sole traders, company directors and even larger SMEs ('small and medium enterprises'). Open a UK business bank account. The UK has many banks that offer business accounts to international businesses and entrepreneurs. Our world-class banking. Virgin Money offers % cashback on your business debit card spending and has an instant access savings account (with a minimum deposit of £1). Starling Bank is one of the newest challenger banks, trying to transform the banking industry in the UK. They offer a generous free bank account tied into a. Virgin Money offers % cashback on your business debit card spending and has an instant access savings account (with a minimum deposit of £1). If you operate as a small business, require everyday transactional banking services and multiple ways to access your account, apply online for our Small. Best business bank account for small business start up · Deals frequently with cash or cheques - NatWest · Want to keep your banking and savings.

Compare our best business bank accounts and apply for your companies account today.

A business current account allows a separation between personal and business transactions for any type of business or company. Discover the best. Best UK business bank for customer service – survey ; Monzo, 84% · Starling Bank, 82% · Handelsbanken ; Monzo, 87% · Starling Bank, 86% · tide. What are some of the best bank accounts for your business? · Revolut Business Basic · Zempler Business Go · Virgin Money M Account for Business · Airwallex Business. Compare our best business bank accounts and apply for your companies account today. The best business bank accounts · Tide Business Account · Cynergy Bank · The Co-operative Bank · Starling Bank Business Account · Virgin Money M account for business. The best business bank accounts · Tide Business Account · Cynergy Bank · The Co-operative Bank · Starling Bank Business Account · Virgin Money M account for business. The best basic bank accounts if you're self-employed ; HSBC Start-Up Account. 18 months free banking. £ 23p (small company) or free e-banking. ; Barclays. What is the Best Bank Account for UK Companies? · Barclays · HSBC · Lloyds Bank · NatWest · Santander · Metro Bank. Bank of Scotland offers a competitive and flexible banking account product that enables businesses to access their accounts through a variety of methods. They. With FSB Business Banking, you can choose a bank account that works for your small business, and get discounts and deals negotiated just for FSB members. Original free business account · Good for business · Starling best-loved · Made for payments. HSBC offers switchers 12 months of free banking. Once the fee-free period is over there is also a choice of two different tariffs available and their Best. 1. Revolut Business — Best Overall. Revolut has made its way to the top of the financial sector and offers a wide variety of services. Best business account providers UK · Monzo Business Lite Account · Starling Bank Business Account · Virgin Money M Account for Business · TSB Business Plus Account. Mettle by Natwest is a current account for sole traders and limited companies with up to two owners. As well as having no monthly fee, it offers free bank. The best free business bank accounts. ; Starling Business. Free. Free. % currency conversion fee, £ delivery fee. Yes ; Monzo Lite. Free. Free. Zempler Bank (formerly Cashplus). Business Bank Account · Ongoing · Business overdraft available upon invitation · Apply in minutes ; Tide Banking. Business Current. Business account deals · Zempler Bank formerly Cashplus Business Account · Revolut Business Basic Account · Virgin Money M Account for Business · Virgin. Coconut is a financial tool that's aimed freelancers, small business directors and the self-employed that seeks to make managing finances – particularly tax. Simplify your small business banking and help your company grow with Bank of America Business Advantage. Open a business bank account, find credit cards.

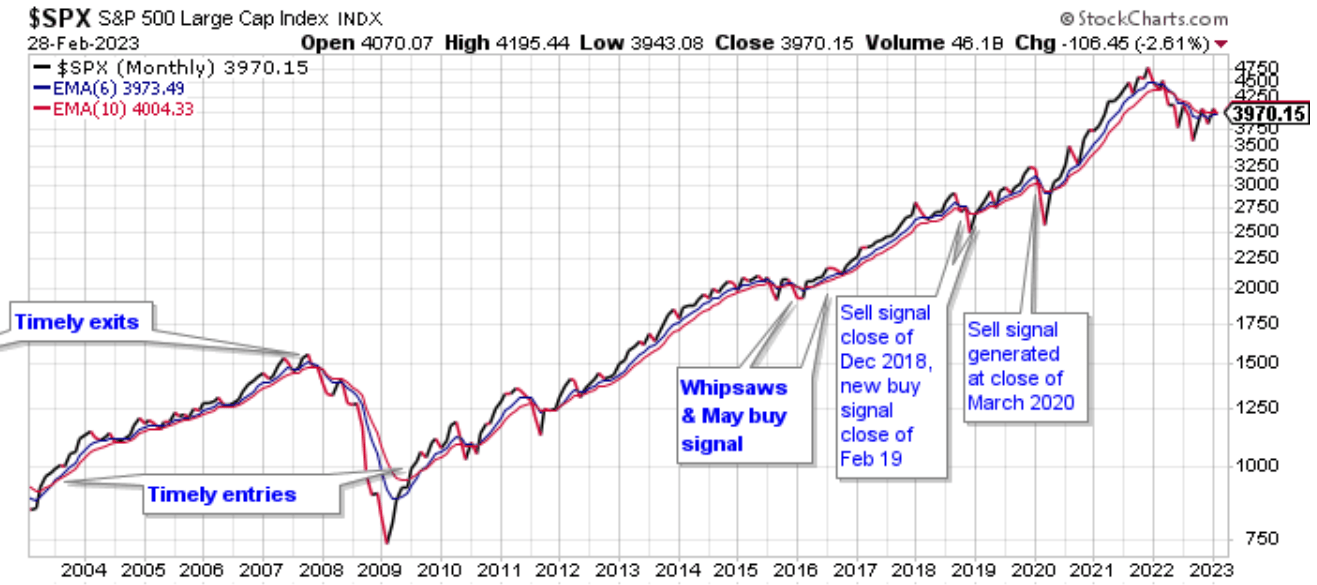

What Stock Mirrors The S&P 500

You can't buy the S&P directly - it's just an index. FXAIX is a mutual fund and VOO is an ETF that try to mirror the S&P index. Passive fund ownership of the S&P is about 24% today- up from 7% ten yrs ago. Meaning that on average an SPX stock has 24% of its shares. What Is the S&P Index? · Microsoft Corp. (MSFT) · Apple Inc. (AAPL) · Nvidia Corp. (NVDA) · ravescape.ru Inc. (AMZN) · Alphabet Inc. A (GOOGL) · Meta Platforms Inc. The Standard & Poor's Index, commonly called the S&P , tracks of the largest companies trading on major US stock exchanges. Investors view the index. The Schwab S&P Index tracks the Standard & Poor's index, one of the most widely watched benchmarks for U.S. stocks. The index covers about Niche passive equity ETFs such as those that mirror the sector subsets of the S&P or the small companies of the Russell , may offer investors focused. The best S&P ETFs by cost and performance: ✓ Ongoing charges as low as % p.a. ✓ 24 ETFs track the S&P S&P Index Fund - SBSPX Invests primarily in the stocks that comprise the Standard & Poor's Index. Pure index fund attempts to mirror. For example, the SPDR S&P ETF Trust (SPY) is a widely utilized exchange-traded fund (ETF) that tracks the S&P First established in January of , SPY. You can't buy the S&P directly - it's just an index. FXAIX is a mutual fund and VOO is an ETF that try to mirror the S&P index. Passive fund ownership of the S&P is about 24% today- up from 7% ten yrs ago. Meaning that on average an SPX stock has 24% of its shares. What Is the S&P Index? · Microsoft Corp. (MSFT) · Apple Inc. (AAPL) · Nvidia Corp. (NVDA) · ravescape.ru Inc. (AMZN) · Alphabet Inc. A (GOOGL) · Meta Platforms Inc. The Standard & Poor's Index, commonly called the S&P , tracks of the largest companies trading on major US stock exchanges. Investors view the index. The Schwab S&P Index tracks the Standard & Poor's index, one of the most widely watched benchmarks for U.S. stocks. The index covers about Niche passive equity ETFs such as those that mirror the sector subsets of the S&P or the small companies of the Russell , may offer investors focused. The best S&P ETFs by cost and performance: ✓ Ongoing charges as low as % p.a. ✓ 24 ETFs track the S&P S&P Index Fund - SBSPX Invests primarily in the stocks that comprise the Standard & Poor's Index. Pure index fund attempts to mirror. For example, the SPDR S&P ETF Trust (SPY) is a widely utilized exchange-traded fund (ETF) that tracks the S&P First established in January of , SPY.

The Nuveen S&P Index Fund seeks total return by investing primarily in a portfolio of large cap equities selected to track U.S. equity markets based on. The iShares Core S&P ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities. John Hancock Asset Management's managers try to match the performance of the S&P Index by holding all, or a representative sample of, the securities that. The S&P is the main benchmark for the stock market. Here are the top S&P ETFs for The biggest S&P ETFs mirror the performance of the. The SPDR S&P ETF Trust (SPY, $) is not just the biggest S&P ETF — it's the largest exchange-traded fund period. It's also the first U.S.-listed ETF. SPY aims to replicate the performance of the S&P index by holding a portfolio of stocks that closely mirrors the index composition. It provides investors. Investors have enjoyed returns the S&P Index has provided over the years, but it's coming at the cost of concentration risk from overexposure to the. Invests in stocks in the S&P Index, representing of the largest U.S. companies. Goal is to closely track the index's return, which is considered a. What are some popular market indexes? · Dow Jones Industrial Average · S&P ® · Nasdaq Composite · Schwab ®. Reversing course, the S&P ® rose % in May. Tech stocks, particularly AI-related names, came back into focus, while the bull market finally began to. ETFs that track the S&P typically hold a proportionate share of the index's constituent stocks. This means that larger companies within the S&P , in. Investment returns and principal value will fluctuate, so investors' shares, when sold, may be worth more or less than their original cost. Current performance. It generally will seek to replicate the performance of the index by giving the same weight to a given stock as the index does. The index includes the stocks of. Passive investment portfolio that invests in equity securities of companies in the S&P Index. Vanguard Total World Stock Index Fund Investor Shares (VTWSX). · Schwab S&P Index Fund (SWPPX). · SPDR S&P Dividend ETF (SDY). · Fidelity U.S. Sustainability. The Schwab S&P ® Index Fund is not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and. SPY (SPDR S&P ETF Trust) and IWM (iShares Russell ETF) are both exchange-traded funds (ETFs) that represent different segments of the U.S. stock market. Market Capitalization is the total dollar value of all outstanding shares computed as number of shares times current market price. The S&P ® Index is a. S&P Index$34, MORNINGSTAR CATEGORY AVERAGE. Large Blend$27, (right Fidelity® Mega Cap Stock Fund . more information. FGRTX. Close. Fidelity. Designed to track the price and dividend performance of the S&P Index. · Invests in stocks included in the S&P Index · Weights stocks based on their.

Pizza Shop Pos

Pizza Point of Sale Software The POS in your pizza restaurant is the foundation upon which your entire restaurant management infrastructure is built—the. With Toast, you'll automatically grow your email list when new guests place orders for takeout or delivery, or when they're dining in-store and opt to sign up. A complete Pizza POS System designed to meet the needs of all pizzerias. Flexible menu build options, inventory management, and more! ✓ Demo Revel. Toast is the only POS platform to offer direct integration with DoorDash, GrubHub and UberEats. Say goodbye to the days of manual double entry and cluttering up. A Pizza POS system that integrates with leading online ordering systems and delivery systems. POSApt is your go-to POS solution. Book Now! The pizza shop POS that's fast, reliable and saves you time · The best POS system for any pizza restaurant · Fire up productivity with a mobile point of sale. A pizza POS system from SkyTab is all you need. Designed for pizzerias to include delivery management, caller ID integration, pizza-specific modifiers. Pizza is a top takeout and delivery food. Customers love placing an order and having it show up to their door. Lavu's pizza POS system makes it each to offer. Pizza and delivery point of sale built for a delivery economy. Whether you have a large franchise or a small restaurant, you need the right POS. Pizza Point of Sale Software The POS in your pizza restaurant is the foundation upon which your entire restaurant management infrastructure is built—the. With Toast, you'll automatically grow your email list when new guests place orders for takeout or delivery, or when they're dining in-store and opt to sign up. A complete Pizza POS System designed to meet the needs of all pizzerias. Flexible menu build options, inventory management, and more! ✓ Demo Revel. Toast is the only POS platform to offer direct integration with DoorDash, GrubHub and UberEats. Say goodbye to the days of manual double entry and cluttering up. A Pizza POS system that integrates with leading online ordering systems and delivery systems. POSApt is your go-to POS solution. Book Now! The pizza shop POS that's fast, reliable and saves you time · The best POS system for any pizza restaurant · Fire up productivity with a mobile point of sale. A pizza POS system from SkyTab is all you need. Designed for pizzerias to include delivery management, caller ID integration, pizza-specific modifiers. Pizza is a top takeout and delivery food. Customers love placing an order and having it show up to their door. Lavu's pizza POS system makes it each to offer. Pizza and delivery point of sale built for a delivery economy. Whether you have a large franchise or a small restaurant, you need the right POS.

POS Pizza is a low cost Pizza POS (point of sale system) designed for Pizza shops and sandwich shops. This software is very easy to learn and to teach to your. Optimize operations with eHopper POS hardware for pizza shops Increase effeciency at your pizza shop by integrating with our various compatible and reliable. In addition to our POS systems and credit card merchant services, we also offer a variety of additional features that can help improve your pizza shop. These. The best POS systems for pizza restaurants will have an app specifically for drivers to use, and the ability for managers to track drivers on their routes. Linga Pizza POS point of sale system is all you need. Designed for pizzeria POS system to include delivery management, caller ID, and specific modifiers. Looking for the best payment processing solutions for your Pizza Restaurant? Electronic Merchant Systems offers exceptional merchant services and credit. Our Pizza POS integrates with leading payment providers, offering your customers multiple ways to pay. The two-way integration works quickly, allowing your. Aldelo POS for Pizza Shops. Help Pizza stores achieve greater savings, unparalleled values, and exceptional efficiencies. Move Your Pizzeria into the Next Level with Pizza POS Software. Restora POS provides a complete solution for your pizza restaurant through this pizza online. Unleash the potential of your pizza shop with our powerful POS system. · Customizing halves, building your own, and swapping toppings is just as straightforward. Boost your pizza restaurant's success with Thrive POS, the best point-of-sale solution for pizza and delivery restaurants. POS Pizza [LT] is a free Pizza POS (point of sale system) designed for Pizza shops and sandwich shops. This software is very easy to learn and to teach to your. Clover's pizzeria POS system is an all-in-one solution for growing pizza shops. Discover how it handles payments, loyalty programs, online ordering. Adora's innovative pizza POS systems help in every aspect, so you can provide a seamless, pleasant experience for every customer, every time. Make your customers happy by delivering quick Pizzas and Pizza bills using Moon Invoice. Management made easy, and billing made simple for Pizza outlets like. Pizza and delivery point of sale built for a delivery economy. Whether you have a large franchise or a small restaurant, you need the right POS. This blog post aims to guide pizza shop owners through the maze of POS systems available today. Our goal is to highlight key features that are essential for. Welcome to the Future with our Pizza Builder POS Software This smart, Intuitive Pizza Builder is your digital sous chef. It expertly manages and refines unique. In addition to making sure the pizza gets to the customer while it's still hot, a pizza POS system also helps ensure that drivers take the correct orders to. With the least training and minimal staff required, Gofrugal offers the best Pizza Point of Sale software you need to grow your pizzeria. Gofrugal's Pizza POS.

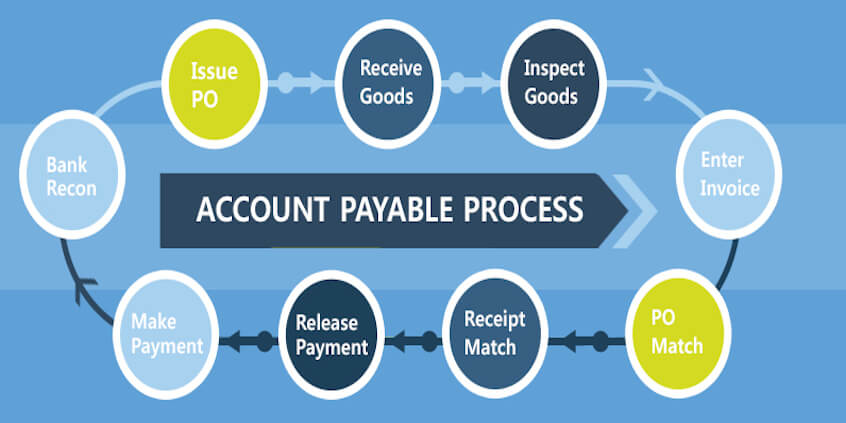

Accounts Paid

Payments & subscriptions. When you sign in to your account, you can see your payment info, transactions, recurring payments, and reservations. Sign in. Search. Suppliers (both companies and individuals) can contact Accounts Payable regarding payment information starting 10 business days after the due date of the. Accounts payable (AP) is money owed by a business to its suppliers shown as a liability on a company's balance sheet. It is distinct from notes payable. You will be prompted to sign in with your university credentials. Finance > Quick Links > Open a Case with Finance >Select Accounts Payable under What is the. Making and Requesting a Payment The Accounts Payable department at Tufts ensures that payments to vendors and individuals are made in a timely manner in. The average payable period measures the average amount of time you use each dollar of your trade credit. That is, it measures how long you use your trade. Accounts Payable is responsible for ensuring that payments for all purchases and expense reimbursements are processed and reported in accordance with university. Accounts payable is listed on a company's balance sheet. Accounts payable is a liability since it is money owed to creditors and is listed under current. Accounts payable, considered a short-term debt obligation owed by a company to suppliers and creditors, are listed on a company's balance sheet. Payments & subscriptions. When you sign in to your account, you can see your payment info, transactions, recurring payments, and reservations. Sign in. Search. Suppliers (both companies and individuals) can contact Accounts Payable regarding payment information starting 10 business days after the due date of the. Accounts payable (AP) is money owed by a business to its suppliers shown as a liability on a company's balance sheet. It is distinct from notes payable. You will be prompted to sign in with your university credentials. Finance > Quick Links > Open a Case with Finance >Select Accounts Payable under What is the. Making and Requesting a Payment The Accounts Payable department at Tufts ensures that payments to vendors and individuals are made in a timely manner in. The average payable period measures the average amount of time you use each dollar of your trade credit. That is, it measures how long you use your trade. Accounts Payable is responsible for ensuring that payments for all purchases and expense reimbursements are processed and reported in accordance with university. Accounts payable is listed on a company's balance sheet. Accounts payable is a liability since it is money owed to creditors and is listed under current. Accounts payable, considered a short-term debt obligation owed by a company to suppliers and creditors, are listed on a company's balance sheet.

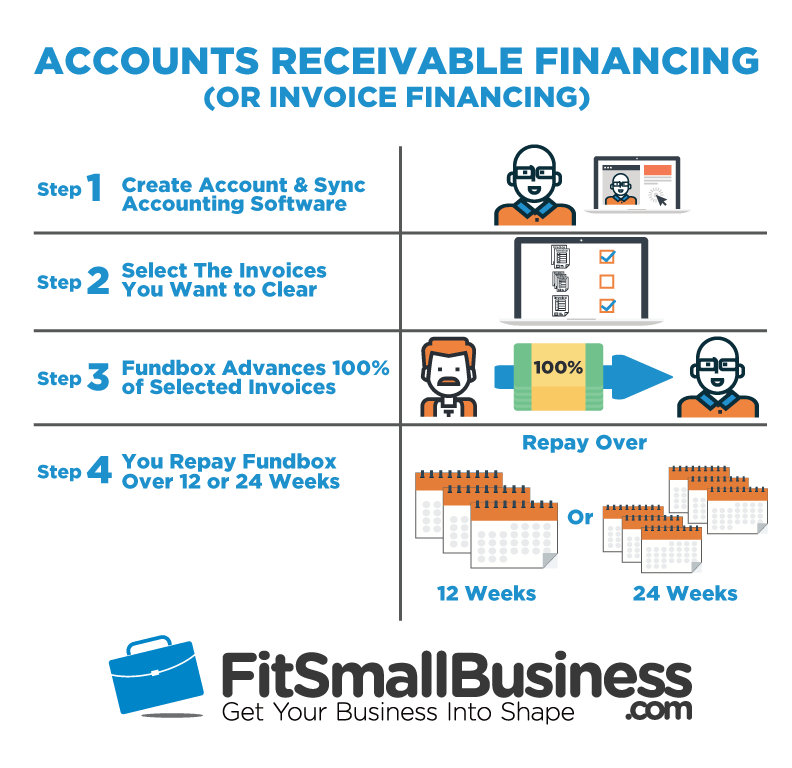

Accounts receivable, abbreviated as AR or A/R, are legally enforceable claims for payment held by a business for goods supplied or services rendered that. Paid invoices normally will not show on the Aged Accounts Payable Report, but here are several possible causes of seeing a paid invoice show on the Aged. Bills payable differ from accounts payable. Whereas bills payable refers to the actual invoices vendors send you as a request for payment, the accounts payable. Accessing your Paid Leave account. Worker Visit the Help Center for tutorial videos and answers to frequently asked questions about Paid Leave accounts. Accounts Payable is a liability due to a particular creditor when it order goods or services without paying in cash up front. Accounts Payable. Responsible for processing vendor invoices for payment of goods and services. Payments are due net 30 days from the date of the invoice. For. bank accounts, you might see higher payout failures for these accounts. USD payments (where USD is the presentment currency) are automatically paid. Accounts Payable is a liability due to a particular creditor when it order goods or services without paying in cash up front. You can add your credit card, debit card, bank account, PayPal account, or mobile phone as a new payment method for your Microsoft account. We have options to pay your account whether you are a Canadian or International student. See below for more details. Accounts payable Accounts payable (AP) is money owed by a business to its suppliers shown as a liability on a company's balance sheet. It is distinct from. Intelligent and easy accounts payable and receivable software. Pay & get paid with Melio B2B bill payment solutions. 1. Build a strong foundation. Customer service should be considered at every stage of your business, especially when it comes to collecting accounts receivable. Get quick access to information about your student account and how to pay your university fees and admission deposit. We would like this page to be a resource for any accounts payable related question you may have. To this end, we have quick links (on the right side of the. We appreciate your assistance in helping us provide best-practice support. Address. Walnut Street Room Philadelphia, PA Accounts Payable Team. Texas Comptrollers of Public Accounts web logo. Glenn Hegar. Texas Comptroller Depending on the tax, Texas taxpayers may be required to electronically report. Generally, vendors send invoices directly to Accounts Payable (AP). Once an invoice has been submitted, AP takes the following actions. Is accounts payable a debit or a credit? Accounts payable is a liability account, which represents the amount of money a company owes to its vendors or. If a student is being reimbursed for expenses paid while conducting UVic business, refer to the information on the reimbursement webpage.

Invoice Funding Companies

Here are 5 of the best factoring companies in the United States to consider for your business funding needs. Scale Funding is a team of invoice factoring experts with over 30 years of experience providing working capital and expert support. Turn unpaid invoices into working capital. Don't wait on net terms. Get a cash advance on your outstanding invoices with invoice factoring via FundThrough. NerdWallet recently named Riviera Finance as the leading non-recourse factoring company in their evaluations. NerdWallet is a Riviera Finance. One key aspect of invoice factoring is the collection of the invoice. When a client fails to pay their invoice, the factoring company takes on the. Invoice factoring allows businesses to sell their outstanding accounts receivable invoices at a discount to a third-party (Factor). Our factoring company provides funding to cover payroll, expenses and other supplier demands to large and small businesses in most industries. It is a financial transaction where a business sells its accounts receivable (invoices) to a third-party factoring company at a discount. In exchange, your. Invoice factoring is a financing plan specifically designed for businesses that issue invoices with net terms, usually between 30 to 90 days. Here are 5 of the best factoring companies in the United States to consider for your business funding needs. Scale Funding is a team of invoice factoring experts with over 30 years of experience providing working capital and expert support. Turn unpaid invoices into working capital. Don't wait on net terms. Get a cash advance on your outstanding invoices with invoice factoring via FundThrough. NerdWallet recently named Riviera Finance as the leading non-recourse factoring company in their evaluations. NerdWallet is a Riviera Finance. One key aspect of invoice factoring is the collection of the invoice. When a client fails to pay their invoice, the factoring company takes on the. Invoice factoring allows businesses to sell their outstanding accounts receivable invoices at a discount to a third-party (Factor). Our factoring company provides funding to cover payroll, expenses and other supplier demands to large and small businesses in most industries. It is a financial transaction where a business sells its accounts receivable (invoices) to a third-party factoring company at a discount. In exchange, your. Invoice factoring is a financing plan specifically designed for businesses that issue invoices with net terms, usually between 30 to 90 days.

Factoring Directory is your go-to resource for all things related to factoring from conducting searches to learning about how factoring accounts receivables. Riviera Finance is an invoice factoring company with more than 25 offices in the US and Canada for all of your invoice factoring needs. Get cash tomorrow. Invoice factoring takes place when a company sells its unpaid invoices (the receivables) to a third party like us. In return, this third party (the “factor”). Invoice factoring is not a traditional bank loan, because it avoids a lot of the pitfalls that befall small business owners during the bank loan application. Businesses in the U.S. & Canada can get paid in a day by advancing funds from unpaid invoices with online invoice financing and factoring from FundThrough. Factoring Directory is your go-to resource for all things related to factoring from conducting searches to learning about how factoring accounts receivables. Best Invoice Factoring Companies ; Lender/Funder*, Loan/FInancing Amount, Min. Time in Business ; Raistone Capital, $50,$50 million, 1 year ; Gillman-Baguley. Triumph, formerly Triumph Business Capital, provides invoice factoring for transportation, providing advances on your outstanding invoices. Get paid today! Invoice factoring company: A company that specializes in purchasing outstanding invoices from businesses. Also known as an invoice factoring services. Factor. Invoice financing companies advance your cash collateralized by your accounts receivable, giving you an excellent way to put money back into your business. With. We offer USA based companies a complete line of invoice factoring services, inventory finance, purchase order financing and other related. Factoring companies allow you to collect on unpaid invoices. We researched and reviewed the best ones based on process, fees, timelines, and more. Invoice factoring lets you sell your company's outstanding invoices at a discount to a third party (known as a “factoring company” or “factor”). When you sell. Invoice factoring is a type of business financing where small business owners sell outstanding invoices to factoring companies (the factor) at a discounted. Invoice factoring is a form of alternative financing that involves selling your outstanding invoices to a third party (factoring company) in exchange for cash. With invoice factoring, the company sells its outstanding invoices to a lender, who might pay the company 70% to 85% up front of what the invoices are. Invoice factoring is a solution that releases cash tied up in your outstanding customer invoices so you can get paid when issuing invoices. eCapital has a long history of providing factoring services to small and mid-sized businesses. It offers reliable, uninterrupted funding with high advance. Submit Invoices. You get to choose which invoices you factor and how often. Once submitted, the invoices will be verified and you will receive a cash advance.